KBank Private Banking and Lombard Odier identify four scenarios of the Russia-Ukraine

KBank Private Banking (KPB) and its strategic alliance Lombard Odier, a world-class Swiss private bank, have identified four scenarios of the Russia-Ukraine war – the key factor that has rocked stock markets worldwide. Investors are recommended to keep abreast of the latest developments. The fluid nature of the situation makes it almost unpredictable. KPB – at the forefront in wealth management and investment expertise – has advised investors to arrange their portfolios to efficiently cope with this crisis.

Mr. Jirawat Supornpaibul, Private Banking Group – Executive Chairman of KASIKORNBANK, noted that the Russia-Ukraine conflict has exacerbated volatility in global stock markets, which have already borne the brunt of soaring inflation over the past month amid rising investor concern. Based on historical data since World War II, the US stock market saw its prices drop by only 1.5 percent on average on the day a crisis erupted, while nosediving from the highs by around 5.4 percent. Meanwhile, the average duration for stock prices to fall to their trough was 15 days, while it took 35 days for them to rebound to pre-crisis levels.As the Russia-Ukraine crisis continues to unfold, Russia has increasingly felt the pinch of economic sanctions issued by various countries, while global oil prices initially soared. A protracted war may cause energy prices to remain at elevated levels for a substantial period, especially if Europe permanently imposes sanctions against Russia’s oil shipments. Under these circumstances, inflationary pressure would be prolonged. Meanwhile, global economic growth has been sluggish, and this has continually affected investment markets. As worldwide stock exchanges have become more volatile than expected, most investors are uncertain whether or not they should adjust their portfolios, and what is the best adjustment amid this crisis.

Mr. Sammy Chaar, Chief Economist at Lombard Odier, has assessed that there are four scenarios of development of the conflict between Russia and Ukraine, as follows:

1.Base-case scenario – Prolonged conflict and failed negotiations (50 percent possibility): Inflation will heighten across the globe, following rising commodity prices and supply chain disruptions caused by sanctions. Global economic growth will slow, especially in Europe. Lombard Odier’s forecast is that GDP growth will drop 1 percent in Europe and 0.5 percent in the US. In this context, worldwide central banks will resort to more stringent monetary policies.

2.Best-case scenario – Russia and Ukraine are able to come to an agreement, but some sanctions would remain in effect (20 percent possibility): The global economy would resume satisfactory recovery. High commodity prices would persist, but at manageable levels. Inflation would gradually decrease.

3.Worse-case scenario – Conflict between the two countries escalates and sanctions further intensify (20 percent possibility): This scenario would significantly impact the global economy. However, Lombard Odier holds the view that recession would not occur, due to the fact that global economic activity is not as heavily dependent on oil as in the past, and up to now, the global economy was in a very healthy position after gradual recoveries of various activities as the COVID-19 crisis eased. In addition, a number of measures have been launched by the governments of each country to sustain economic growth, for example, assistance for low-income earners’ living expenses.

4.Worst-case scenario – Worldwide expansion of conflict (10 percent possibility): The world economy would likely enter recession, and financial crisis may arise. All central banks would delay stringent policies and shift to a policy of maintaining financial stability.

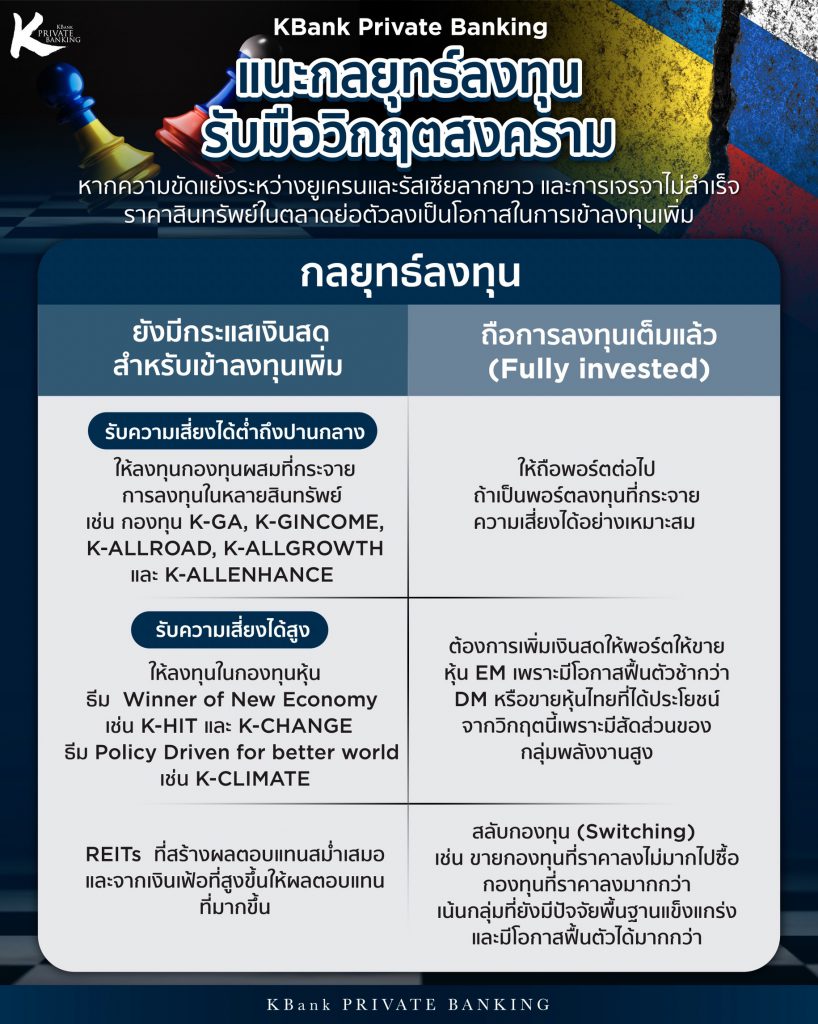

Regarding investment portfolio adjustment guidelines, Ms. Siriporn Suwannakarn, Senior Managing Director – Financial Advisory Head of Private Banking Group, KASIKORNBANK saidthat the magnitude of the Russia-Ukraine conflict’s impacton the economy and investment will depend upon its severity and the duration of its sanctions. For instance, if the crisis has a substantial impact on the economy, and large countries have no measures to support their economies or are too slow to implement stringent policies, asset values may be affected. Although asset values could recover quickly once the crisis eases, returns may not be recouped within a short period. However, KPB holds the view that there is a 50-percent chance that the Russia-Ukraine conflict will be prolonged, and a deal will not soon be reached. Therefore, it is a good time to invest when asset values in the market decline. Regarding investment strategies, high net worth individual (HNWI) clients are advised to consider two cases, as follows:

1.If investors still have sufficient cash for additional investment and can hold their investment for more than three years, or they already have investment in highly liquid assets such as funds that can be traded on a daily basis as a major part of their investment, the first thing that they must consider is risk tolerance, or their own risk profile. For instance, those with low-to-moderate risk tolerance are advised to invest in mixed funds that diversify investment towards multiple asset classes such as K-GA, K-GINCOME, K-ALLROAD, K-ALLGROWTH and K-ALLENHANCE. Clients with high risk tolerance are advised to invest in equity funds such as K-HIT and K-CHANGE under the ‘Winner of New Economy’ theme because they have solid fundamentals over the long term, diversify investment across various business sectors worldwide and often experience heavy selloffs triggered by concerns in markets. If the Russia-Ukraine crisis eases, such funds may have a higher chance of recovery at a faster rate than other stock categories. HNWI clients are advised to invest in the K-CLIMATE fund under the ‘Policy Driven for Better World’, as well, because it is in line with the megatrend, and the value does not decline substantially compared to other stock categories Additionally, they should invest in real estate investment trusts (REITs) which offer consistent returns and have the potential to offer even greater returns as inflation rises.

2.In case investors are already fully invested, the first thing that must be done is to assess whether or not they hold a long-term investment portfolio that has appropriate risk diversification. If the answer is yes, we recommend investors to continue holding the portfolio as the situation in Ukraine will tend to gradually improve. However, if investors wish to increase cash in their portfolio, they are advised to sell emerging market stocks as such investments are likely to recover more slowly than stocks from developed markets, or to sell Thai stocks, especially a high proportion of energy stocks, that have benefited from the aforementioned crisis. Fund switching is also advised. For example, the investor may sell a fund that has dipped only slightly in price to buy a fund that has experienced a bigger drop in price. Focus should be on stocks with solid fundamentals and tendency to recover more quickly. Nonetheless, there is a switching fee, and the investor’s own investment strategy should also be taken into account.

Mr. Jirawat said in closing that the crisis stemming from the conflict between Russia and Ukraine has caused asset prices to fall quickly and drastically. KBank Private Banking maintains its advice for investors to hold on to their present portfolio as long as it is long-term and risks have been diversified appropriately. KBank will continue to monitor the situation in Ukraine closely in order to make suitable adjustments to clients’ portfolios and investment strategies regardless of circumstances in order to provide satisfactory returns for investors’ portfolios in 2022.