KX upgrades Bigfin with the latest integration to Binance

the world’s largest cryptocurrency exchange platform

To advance Bigfin – a digital asset investment tracking and analysis platform – to the next level, KASIKORN X Co., Ltd. (KX) has linked it to Binance, the world’s number-one cryptocurrency exchange platform with 128 million accounts, in order to reach out to crypto investors worldwide. Given its distinctive features, Bigfin allows investors in the cryptocurrency world to track and conduct analyses with ease and enhanced efficiency. KX is ready to develop this platform’s features continually in order to serve investors once the digital asset market makes a comeback.

Mr. Paul Arriyavat, Venture Director of KASIKORN X Co., Ltd. (KX), said that the cryptocurrency and digital asset market has been in the bear market since late 2021. This is a blessing in disguise as investors have had more time to rearrange their portfolios while equipping themselves with tools to help them efficiently manage their investments and decision-making to be prepared once the market picks up. In response to this trend, KX has introduced Bigfin, a digital asset investment analysis platform that helps enhance efficiency in portfolio management for retail investors worldwide.

Recently, Bigfin added an integration to Binance, the world’s most-used cryptocurrency exchange platform, with approximately 128 million accounts as of the end of 2022. Thanks to this connection, users with Binance accounts in both Thailand and worldwide (except Binance.US users) are able to thoroughly track the profits and losses of their portfolios through Bigfin’s features, which have been developed to meet the needs of crypto investors, including new investors who want to keep a trading journal to keep abreast of their investment status, including costs, profits/losses and the efficiency of their initial trading performance, as well as those who previously lacked the time to keep track of their investments. During the initial phase of connection with Binance, Bigfin will supports the top 200 coins by market capitalization on Binance, along with stablecoins such as USDT, USDC, and BUSD. New chains and coins are scheduled for development in the future.

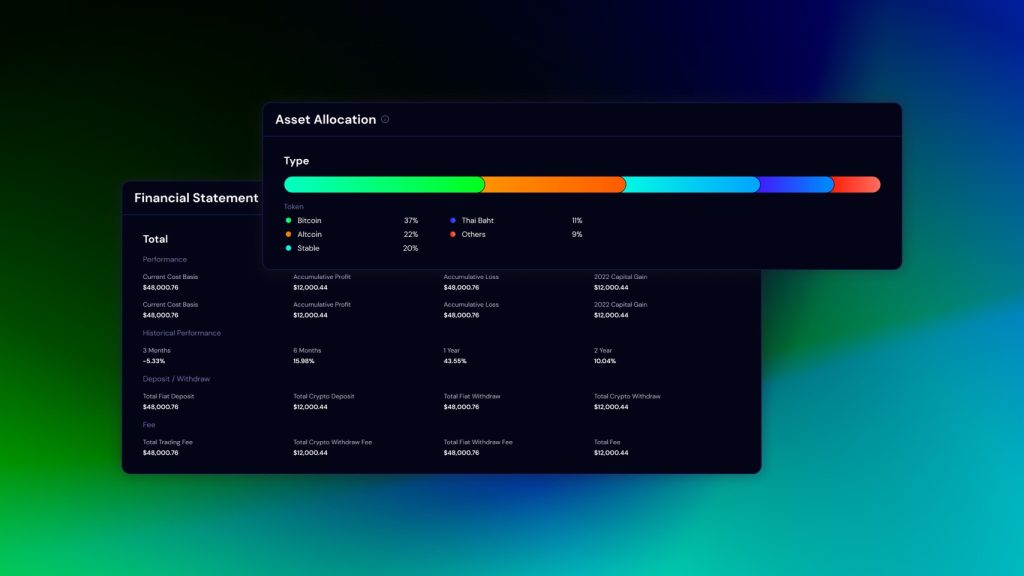

Mr. Arriyavat added that what sets Bigfin apart from other cryptocurrency and digital asset portfolio analysis tools is the fact that it uses users’ transaction data to calculate the real cost, based on First in, First Out (FIFO) of each coin, right at the beginning of trading. As a result, Bigfin can calculate data to find the real cost of trading on any cryptocurrency platform more accurately, such as realized/unrealized P/L of each coin and the overall portfolio. Viewing realized/unrealized P/L is the most often used feature. Additionally, key highlights of Bigfin are viewing graphs presenting historical values of users’ portfolios; running balance showing profit and loss at the portfolio level or for each asset; easy-to-understand transaction history by category, asset transactions and transaction fees in a clear and straightforward format; as well as a Crypto Deposit Edit feature allowing users to record costs of transferred coins from airdrop or off-board trading for solid profit and loss calculation. Bigfin has connected to leading crypto trading platforms at home and abroad, namely Bitkub, Ethereum, and Binance – the latest one. KX will further develop Bigfin’s features to serve investors, especially when the digital asset market makes a comeback. Currently, there are around 3 million accounts of crypto investors at digital assets exchanges in Thailand, and more than 100 million accounts worldwide. Interested persons can view details and sign up for Bigfin at https://bigfin.finance.