EXIM Thailand Teams up with NEXI to Provide Risk Hedging

Thai and Japanese Entrepreneurs in Expansion of Trade and Investment to Target Countries along Greater Mekong

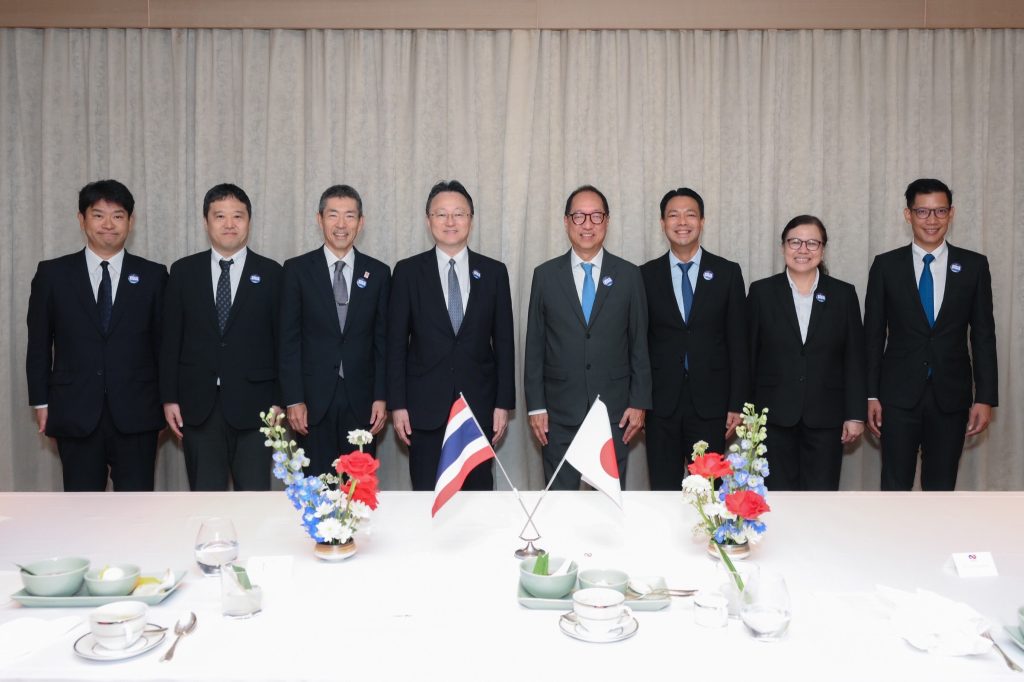

Dr. Pasu Loharjun, Chairman of Export-Import Bank of Thailand (EXIM Thailand), and Mr. Oba Yuichi, Charges d’Affaires Ad Interim, Embassy of Japan in Thailand, presided over the opening ceremony of a seminar titled “EXIM Thailand and NEXI Collaboration: A New Chapter Begins” organized by EXIM Thailand in joint forces with Nippon Export and Investment Insurance (NEXI) at Capella Bangkok Hotel on June 7, 2023. The seminar, participated by more than 100 Thai and Japanese entrepreneurs, aimed to provide the entrepreneurs with knowledge, opportunities and financial tools in terms of both credit and insurance facilities. Both organizations would jointly support Thai and Japanese entrepreneurs in access to fresh opportunities in trade and investment in countries along the Greater Mekong Subregion (GMS). Speakers at the event were Dr. Rak Vorrakitpokatorn, EXIM Thailand President; Mr. Narit Therdsteerasukdi, Secretary-General, Thailand Board of Investment (BOI); and Mrs. Arada Fuangtong, Deputy Director-General, Department of International Trade Promotion, Ministry of Commerce.

EXIM Thailand Chairman said that, at present, countries along the GMS, particularly Lao PDR, Cambodia and Vietnam are New Frontiers with high trade and investment potential and consistently recording robust economic growth with availability in multiple facets, such as low labor cost, abundant natural resources, increasing number of consumers with higher purchasing power, ongoing urbanization and industrial development, political stability, and bilateral and multilateral free trade agreements. All these factors would attract investments of entrepreneurs from countries around the world, contributing to target countries’ national development, along with relocation of production bases of products and operation of service businesses to serve domestic consumption and for export to third countries like China and India. In this regard, Thai and Japanese entrepreneurs would be major investors to fulfill such needs and enhance linkage with global supply chain.

Meanwhile, Dr. Rak Vorrakitpokatorn, EXIM Thailand President, pointed out that this new chapter of collaboration between EXIM Thailand and NEXI in the global trade of the new era focuses on exchange of information and cooperation in development of financial tools, covering export credit and investment insurance, as well as reinsurance facilities, with a view to safeguarding Thai and Japanese entrepreneurs against international trade and investment risks and amplifying efforts to drive together national development of Asian countries. These include uplifting their people’s well-being, development of infrastructures and public utilities, labor skill development, and transfer and exchange of knowledge base andtechnology. Both institutions would promote and support Thai and Japanese entrepreneurs who are well-positioned to confidently start up or expand international businesses, particularly in new frontiers with good prospects, e.g. countries along the GMS, where there is similarity and familiarity of the cultures and behaviors of consumers. EXIM Thailand will optimize its expertise in promotion of export and investment by filling knowledge gap, opportunity gap and capital gap, and making available risk hedging tools for international trade and investment.

As predicted by world leading insurance agencies, there could be an over 14% year-on-year increase in the number of bankrupt businesses as business sectors have been ravaged by the prolonged COVID-19 pandemic and Russia-Ukraine tensions. International trade operators, SMEs in particular, which have low negotiating power and small working capital, should thus manage risk of non-payment for goods by shifting their export markets to those with high growth or high purchasing power, such as emerging markets along the GMS, South Asia, and so on, and employing financial tools to manage such risks. EXIM Thailand has operated export credit insurance business since its official start of business operation in 1994. It has so far recorded accumulated export credit insurance turnover of 1.82 trillion baht and total insurance claim payment of approximately 1,400 million baht. Of the total claim payment, 76% has been caused by foreign buyers’ rejection of payment for goods, around 23% due to buyers’ bankruptcy, and the remaining 1% coming from buyers’ rejection of delivered goods. Countries with highest claim value are the United Arab Emirates, the US and Singapore, respectively, while the products with the highest claim value are rice, jewelry and accessories, and aluminum, respectively. “This cooperation with NEXI is another mission of EXIM Thailand as a state-owned specialized financial institution under the supervision of the Ministry of Finance. We have been committed to performing our role as Thailand Development Bank by expanding our collaboration with alliance agencies both at home and overseas, fully arming Thai entrepreneurs and advancing them to act as economic warriors in the world markets, and driving sustainable development at both national and Asian levels in economic, social and environmental dimensions,” added Dr. Rak.