SCB introduces new features of EASY-D Debenture Account

Following the success of launching the “EASY-D Debenture Account: Debenture Deposit Service” via SCB EASY App, Siam Commercial Bank (SCB) has expanded the new features of the EASY-D Debenture Account to further improve a seamless investment experience for retail investors.

This superior one-stop investment service provides investors convenience to deposit debenture certificate by changing the holding format from scrip to scripless and to combine all scripless debentures in one single place. Investors can also transfer debentures from other securities houses to their EASY-D Debenture Account for more convenient debenture investment management by having consolidated portfolio via the SCB EASY App. SCB is also confident that its tech capabilities will respond the needs of digital investors.

SCB Head of Primary Markets Distribution Division, Investment Banking and Capital Markets Mr. Yossavee Suttikulpanich said that the launch of the “EASY-D Debenture Account” to offer scripless debenture deposit in the first quarter this year, has enhanced the digital investment experience for retail investors. They can open an EASY-D Debenture Account easily, subscribe and deposit scripless debentures simultaneously to their EASY-D Debenture Account via SCB EASY App. This provides a secure and convenient option for scripless debenture depository service with the Bank for retail investors. EASY-D Debenture Account holders can enjoy their debenture investment portfolio visibility via SCB EASY App and be able to plan their investment management anywhere, any time. Thanks to the very warm response from retail investors to the EASY-D Debenture Account, the number of investors subscribing for debentures via the SCB EASY App and requesting debenture certificates has dropped sharply from 86% to less than 50%, already achieving the 3-Year target set initially.

SCB has continuously strived for developing the EASY-D Debenture Account features to comprehensively cover the needs of investors and in preparation for supporting the constant growth of investment through digital platforms. This is in line with SCB’s strategy to become the ‘Digital Bank with a Human Touch’ and its commitment to environmental care, by promoting online transactions to reduce paper usage of debenture certificates. Thereby, the development of the EASY-D Debenture Account and the new features are essential to unlock the limitations of earlier investment practices. From now on, investors can deposit debenture certificates into their EASY-D Debenture Account and can also transfer their debentures from other securities houses to the EASY-D Debenture Account, combining their debenture investment portfolio in one single place. Given these new services to serve investors’ need, SCB hopes for a constant 20% growth in the number of EASY-D Debenture Accounts in 2024, growing further after the launch in 2023.

“This new service would broader debenture investment opportunities to retail investors and helps investors to move forward to digital investors. They can also plan their investment management anywhere, any time, so there’s an opportunity for growing their wealth more effectively. Continuously, we have been determined for the new feature developments in 2024 to support debenture investment in the market and digital investment trends.”

Clients can request for depositing debenture certificate to their EASY-D Debenture Account at any SCB branches and can contact securities houses to transfer debentures into their EASY-D Debenture Account from 29 November 2023 onwards. For convenience, it is recommended that clients open an EASY-D Debenture Account before using the new features and preparing for upcoming debenture subscriptions through SCB EASY App.

EASY-D Debenture Account applicant qualifications

1. Thai national with a minimum age of 20

2. Possess an SCB deposit account tied with SCB EASY App

3. Have verified e-mail address and mobile phone number

4. Have completed the identity authentication process with SCB

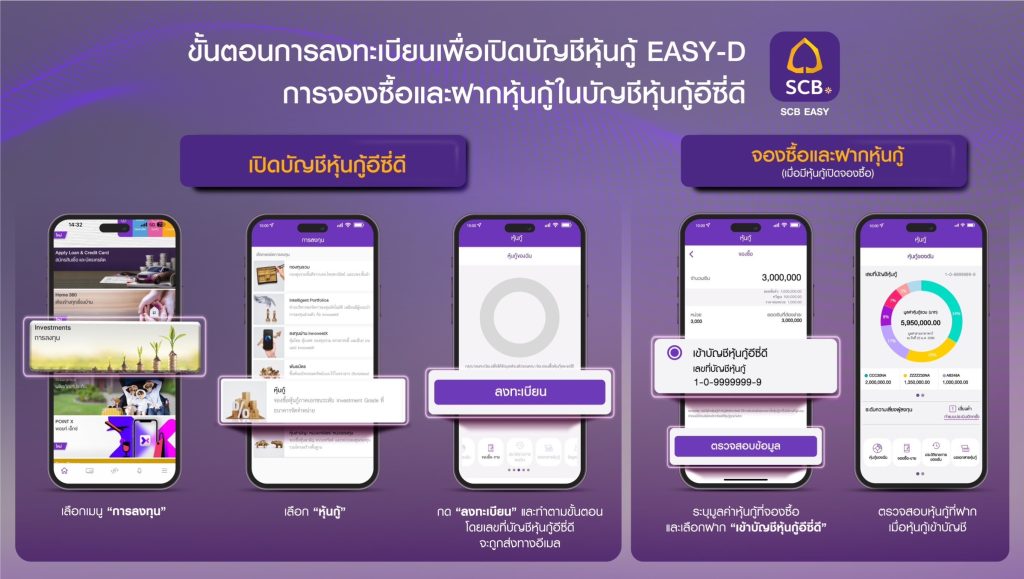

How to apply for an EASY-D Debenture Account