K PLUS – the launch of ‘The 8scape’ thriller on September 29

KASIKORNBANK (KBank) has touted its success as the number-one mobile banking platform in Thailand, as evidenced by the number of users – now topping 19 million – 80 percent of whom use K PLUS regularly. To further strengthen its status under the #KPLUS #TheGoodyApp concept, K PLUS can serve customers in their daily lives, ensuring greater convenience for all lifestyles’ needs when it comes to financial matters. Regardless of circumstance, customers will open K PLUS, showing that K PLUS is the most-recognized brand. In the latest development, KBank is launching “The 8scape” miniseries, featuring a thriller where the main character escapes to survive a murder attempt. The thriller will be released on eight consecutive days from September 29 to October 6, at 8:00 p.m., on every KBank Live platform.

Mr. Pipatpong Poshyanonda, KBank President, said, “K PLUS aims to provide greater convenience to our customers in using multiple forms of financial services in alignment with their spending needs in their daily lives. To make K PLUS customers’ main channel for accessing myriad KBank services, K PLUS has been developed to be a full-fledged “Open Banking Platform” which can link to our partners’ platforms across various businesses. This initiative allows our customers to access any financial service, both online and offline, within Thailand and other countries.”

The number of K PLUS users is now over 19 million, more than 80 percent of whom are regular users, while monthly transactions now exceed 2,800 million. KBank expects to reach more than 20 million users by the end of this year, with total transactions for the entire year amounting to more than 30,000 million.

Mr. Pipatpong noted the fact that customers are using K PLUS for their spending, lifestyle and business needs on a daily basis is a result of constant development of services in four aspects, namely 1) Creation of excellent and seamless service experiences, in terms of K PLUS usage and K PLUS connectivity with a number of channels of business partners without having to switch between the applications, plus the stability of the K PLUS system; 2) Simplified steps for application for financial services on K PLUS, especially for customers having an urgent need for funds or alleviation of their spending burdens, e.g., application for and approval of personal loans, or installment payments; 3) Enhancement of capabilities for cross-border transactions, e.g., international funds transfers, and payments to merchants in foreign countries via QR code (QR Code Cross-Border Payment); and 4) Improvement of the K Point accumulation program to offer multiple privileges and diverse methods and channels of point redemption.

Recently, K PLUS triggered a new trend, helping reinforce KBank’s leadership in the digital banking realm through the launch of a miniseries called “The 8scape” which has eight episodes with eight thrilling stories. It is directed by Mr. Pairach Khumwan, who is also one of the directors of the ‘Girl from Nowhere Season2’. The first episode of “The 8scape” is scheduled for release on September 29, 2022, at 8 p.m., on KBank Live on all platforms, including Facebook, TikTok, YouTube, Twitter, LINE and Instagram. It is a thrilling series featuring people who are fleeing murderers, being trapped in terrifying situations and facing challenging circumstances. The audience will be glued to the characters’ groundbreaking ways to survive no matter how challenging the situation is. #KPLUSFirst will instantly change the game in line with the #KPLUS #TheGoodyApp.

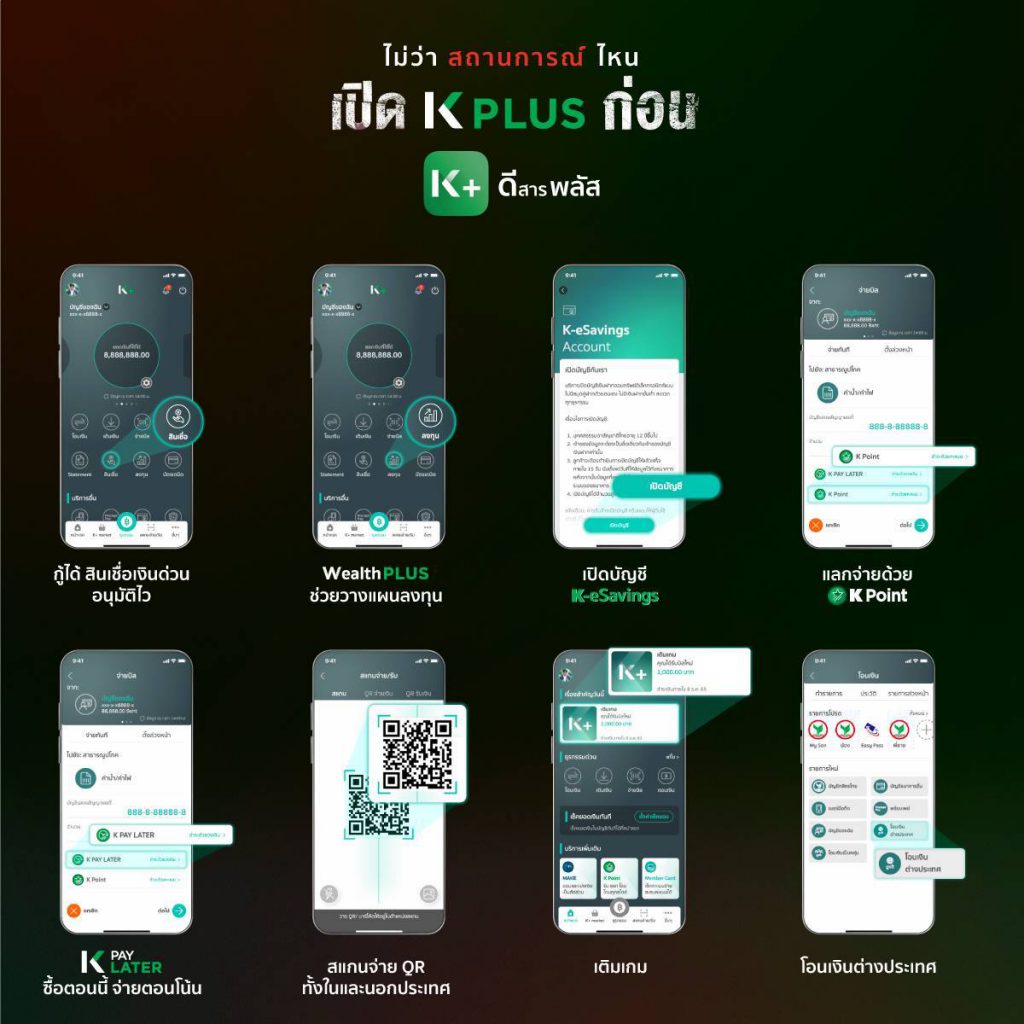

Examples of K PLUS features that have seen constantly growing use among customers

1.Express loans, with speedy approval process and instant cash – Applications for loans such as Xpress Loan and Xpress Cash can be made by customers themselves via K PLUS.

2.Wealth PLUS – an assistant to help plan your investment – This feature is an automatic personal investment planning service that helps customers make appropriate investment plans in line with their respective financial goals and risk appetites. Customers can also choose to make an automatic monthly investment. Wealth PLUS will help adjust such investment plan every three months.

3.Opening K-eSavings account anywhere with no fee – Customers who have never had an account with KBank can easily open the K-eSavings account via K PLUS. Customers aged 12 years or older can apply for the K-eSavings account. Just download K PLUS and verify your identity with your National ID card at any K CHECK ID point.

4.Redeem K Point for various purposes – A digital loyalty points program on K PLUS which allows customers to earn and collect points through spending for products and services as determined by KBank. K Point can be used for purchases or discounts, utility bill payment or other daily needs. Also, customers can transfer their K Point to other loyalty programs of numerous leading brands.

5.Use K PAY LATER to buy now and pay later – This loan allows customers to spend on daily necessities under the “buy-now-pay-later” concept. Application is easy, as income-related documents and collateral are not required. Customers can use the credit limit by “scanning, tapping and paying” via K PLUS at participating stores and choosing “K PAY LATER”. They can also choose a repayment period of either 1, 3 or 5 months.

6.Scan QR Code for domestic and overseas payments – K PLUS users can make QR Code payments at participating merchants nationwide. They can also make QR cross-border payments at more than 30 million merchants displaying the UnionPay QR Code or Yun Shan Fu sign in more than 40 countries/regions. Aside from the convenience of not having to carry cash when travelling, K PLUS users will enjoy reasonable exchange rates, with no minimum spending amount or service fees.

7.Easy to top up games anywhere, anytime – Gamers can top up via K PLUS easily and conveniently to enjoy non-stop gameplay.

8.Transfer funds overseas easily and quickly with just a few clicks – K PLUS users can make international funds transfers in 14 currencies to 32 destination countries/regions with low fees. Recipients will get the full amount of funds promptly, or within 3 business days.

See more information #KPLUS #TheGoodyApp, Click www.kasikornbank.com/kplus162