SCB CIO sees Thailand’s political uncertainty

SCB CIO sees Thailand’s political uncertainty as short-term risk, recommending long-term investment in RMF, SSF

The SCB CIO considers the uncertain Thai politics as a short-term risk but a long-term investment opportunity and recommends buying Thai stocks in the tourism, consumer, and hospital sectors. On another political uncertainty from the US, the debt ceiling negotiation is likely to be a last minute deal on the back of divided government and narrow majorities in both houses of Congress. SCB CIO suggests to accumulate US utility stocks and large US tech giants. After a more than 14% increase due to the dropping yen and the reopening of cities, the SCB CIO recommends selling Japanese stocks gradually. The ECB is expected to raise the interest rate twice by 0.25% and maintain it at 3.75% until 2023.

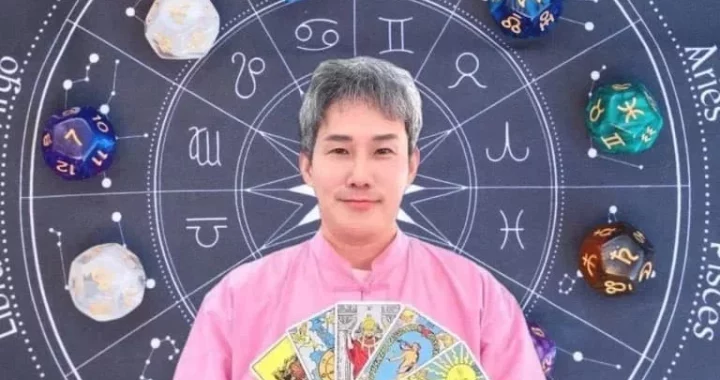

Dr. Kampon Adireksombat, First Senior Vice President and Team Head of the SCB Chief Investment Office at Siam Commercial Bank revealed that there are currently two political uncertainties that investors need to keep an eye on: the government forming in Thailand and management of public debt ceiling in the US. These are considered short-term risk to the market but comes with long-term investment opportunities.

The Thai government forming process remains uncertain and may take longer than usual, as the Prime Minister requires 376 or more supporting votes from the House of Representatives and the Senate combined. According to the legal framework, the first meeting of the House must be held by July 28. However, this process coincides with the ongoing recovery of the Thai economy. In the first quarter of 2023, the Thai economy experienced a growth of 2.7% YoY, compared with 1.4% growth in the fourth quarter last year. On the quarter on quarter basis (seasonally adjusted), the Thai economy expanded 1.9% (vs -1.1% in 4Q22), supported by a strong recovery in private consumption and tourism. Consequently, the likelihood of the Thai economy entering a technical recession has significantly decreased.

While specific details regarding the new government’s economic stimulus measures remain sparse, their potential impact on the economy is expected to be less significant compared to previous measures. This is primarily due to the existing high public debt-to-GDP ratio (61.2% vs 43.3% in 2014), leaving limited fiscal space available for additional stimulus. Furthermore, household debt stands at a considerable 87% of GDP (vs 80% in 2014), further constraining lending activity in the financial sector as caution prevails.

According to the SCB CIO, the Thai stock market has successfully emerged from an earnings recession, which refers to the period when listed companies experienced two consecutive quarters of profit contraction compared to the corresponding period in the previous year. The current market index is believed to have already factored in potential risks related to political issues. As a result, this presents a favorable opportunity for long-term investment, particularly in RMF and SSF. Furthermore, investors are advised to consider accumulating stocks in sectors such as tourism, consumer goods, and hospitals, which have demonstrated robust performance and continue to exhibit signs of recovery. Additionally, the forward P/E ratio of Thai stocks has shown a decline from 15.4 times prior to the election to 15.0 times (with a standard deviation of -0.5).

The US public debt ceiling issue has the potential to introduce volatility into the global financial market. However, it is anticipated that this matter will primarily impact the US economy in the short term. Despite this, the US labor market remains robust, while the US stock market is currently experiencing an earnings recession. The injection of political uncertainty into the equation can exacerbate market volatility.

Given the divided government, with the legislative and executive Congresses representing different parties, and the narrow majority of votes in each House, the passage of the bill is expected to involve prolonged negotiations and bargaining. This factor could have adverse consequences, particularly if there is a default on debt obligations. Nevertheless, the SCB CIO expresses confidence in the likelihood of a last-minute deal being reached, possibly accompanied by some spending budget cuts.

Dr. Kampon has further remarked that various options have been evaluated to address the US debt ceiling issue, including raising the debt ceiling. However, it is anticipated that the bill to increase the debt ceiling will ultimately pass Congress. In the event that a consensus cannot be reached before the approaching X-date, which marks the expiration of the US government’s special measures and cash flow, we expect the authorities to choose one of two options. Firstly, they may pass a law to slightly increase the debt ceiling, or alternatively, they may pass a law to temporarily postpone the debt ceiling until September 30, potentially in conjunction with the spending plan for fiscal year 2024.

Furthermore, a comparison of the management of the debt ceiling crisis in 2011 and 2013 reveals notable differences. In 2011, the debt ceiling was lifted mere hours before the deadline, resulting in significant market volatility and a decline in the stock market. The negotiations during this period were highly uncertain, leading to S&P Global Ratings downgrading the US credit rating from AAA to AA+. In the month prior to and following the debt ceiling increase, the S&P 500 index dropped by 12%, while the 10-year US Treasury (UST) yield decreased by 1.13 percentage points. However, the impact on the US dollar was relatively mild. In contrast, in 2013, the debt ceiling was raised one day before the deadline, resulting in a 5% increase in the S&P 500 index. The effects on the 10-year UST yield and the US dollar were limited.

The investment landscape is influenced by various factors, including the prolonged inflation situation in Europe, which has exceeded initial expectations. Despite the European economy’s positive recovery trajectory, the European Central Bank (ECB) is likely to continue raising interest rates. While the Federal Reserve has halted its interest rate hikes, the ECB is projected to increase rates by an additional 0.25% on two occasions, until reaching a rate of 3.75%, which is expected to be maintained until the end of 2023. On the other hand, we maintain our view that the Fed will keep its interest rate within the range of 5.0-5.25% until the end of 2023. This is attributed to ongoing tensions in the US financial sector, which exhibit an upward trend, making it less likely for the Fed to pursue further rate hikes. Additionally, although inflation has moderated and the labor market remains strong, these factors contribute to the Fed’s reluctance to implement interest rate cuts this year.

According to the SCB CIO, the present market conditions provide an opportunity to accumulate defensive stocks within the US stock market, particularly in the utility sector. These stocks are known for their low volatility and dividend offerings. These stocks are considered to have reasonable valuations and earnings growth. Furthermore, the mega-tech conglomerates also stand to benefit from their strong performance, the decline in bond yields, and their relative resilience to the risk of an economic recession.

Dr. Kampon further added that the SCB CIO has revised its outlook on Japanese stocks to a slightly negative stance from a neutral position. This adjustment is prompted by the significant rise of the Japanese stock market, which has exceeded 14% since the beginning of 2023. This rise can be attributed to the Japanese yen depreciating over 4% against the US dollar and the reopening of the country. Looking ahead, Japan faces an increased inflation risk due to anticipated wage adjustments scheduled for July. As a result, the Bank of Japan may adjust its policy to manage the yield curve, leading to a potential increase in Japanese government bond yields. In contrast, US government bond yields are expected to decrease as the Fed has halted interest rate hikes due to the risk of a recession in the US. These factors could cause the Japanese yen to appreciate.