SCBS transitioning global and Thai economic cycles from reflation to stagnation

transitioning global and Thai economic cycles from reflation to stagnation

SCB Securities sees the conflict between Russia and Ukraine having a negative impact on macroeconomic and global economic growth, resulting in high inflation due to rising oil and other energy prices. These factors will continue to influence the US Federal Reserve’s decision to signal a more aggressive and rapid rate hike. However, the conflict will have a limited impact on Thailand. SCBS anticipates the Bank of Thailand raising the benchmark rate by at least 25 basis points in 2H22. Investors should seek out opportunities in securities associated with the service sector, which enjoys significant pricing power and domestic consumption. Economic growth-wise, the easing of lockdown restrictions on domestic and international travel will be critical to the economy’s chances for a slow recovery through 2022. The economic cycle is now shifting away from reflation (a state frequently observed when an economy and consumer spending begin to recover) and toward stagflation (a state in which economic growth is less than inflation). For the 2Q22 strategy, the SET Index is expected to move between 1550 and 1780 points, with a target of 1,660 points based on fundamentals, with downside risk due to the downgraded 2Q22 earnings forecast. SCBS advises investors to concentrate their efforts on passive stocks with high and stable margins, growth stocks with reasonable valuations, and quality stocks with strong balance sheets and free cash flow (FCF). AOT, BDMS, CRC, GULF, and PTTEP are among the top picks.

Speaking about the 2022 stock outlook, SCBS Managing Director and Chief Research Officer Sukit Udomsirikul noted that increased fuel prices have resulted in a shift toward tighter monetary policy, with growth forecasts being revised downward and the path of economic growth becoming more uncertain, resulting in the economic cycle transitioning from reflation to stagflation. Although the likelihood of a recession in 2022 is greater, it will be a mild recession, as the global economy is not currently so out of balance that it requires adjustment, along with relaxation of travel restrictions and the reopening of countries. Fundamentally, the 2022 SET Index is targeted at 1660 points. Investors should buy between 1550 and 1600 points and exit above 1780 points. The SET is expected to adjust slightly in 2Q22 to absorb the risk of stagflation, while 2H22 will benefit from the country’s reopening and recovery following the COVID-19 pandemic, as well as the low base last year. There is a high probability of a Sell in May event, with a downtrend providing an excellent opportunity to build a position in light of the Thai economy’s apparent quasi-reflation in 2H22.

Direct impacts of the Russian crisis on the Thai economy are unlikely to be severe. However, the indirect effect of rising oil prices on inflation and monetary policy will be more significant. The global and Thai economies are both at risk of stagflation in the next 3-6 months as a result of the energy crisis. Tighter monetary policy poses a policy risk, as it has the potential to push the economy into recession over the next 12 months. Thai economic growth is likely to be slower than previously forecast at 3.63 percent, increasing the risk of stagflation. Financial transfer risk is likely to be manageable, whereas risk associated with transfers and portfolio restructuring may take time to manage. SCBS believes that passive stocks will continue to outperform actively managed stocks, and upstream energy stocks are an excellent hedging option against rising inflation. SCBS continues to favor high-quality stocks with a low beta in order to minimize the impact of volatility.

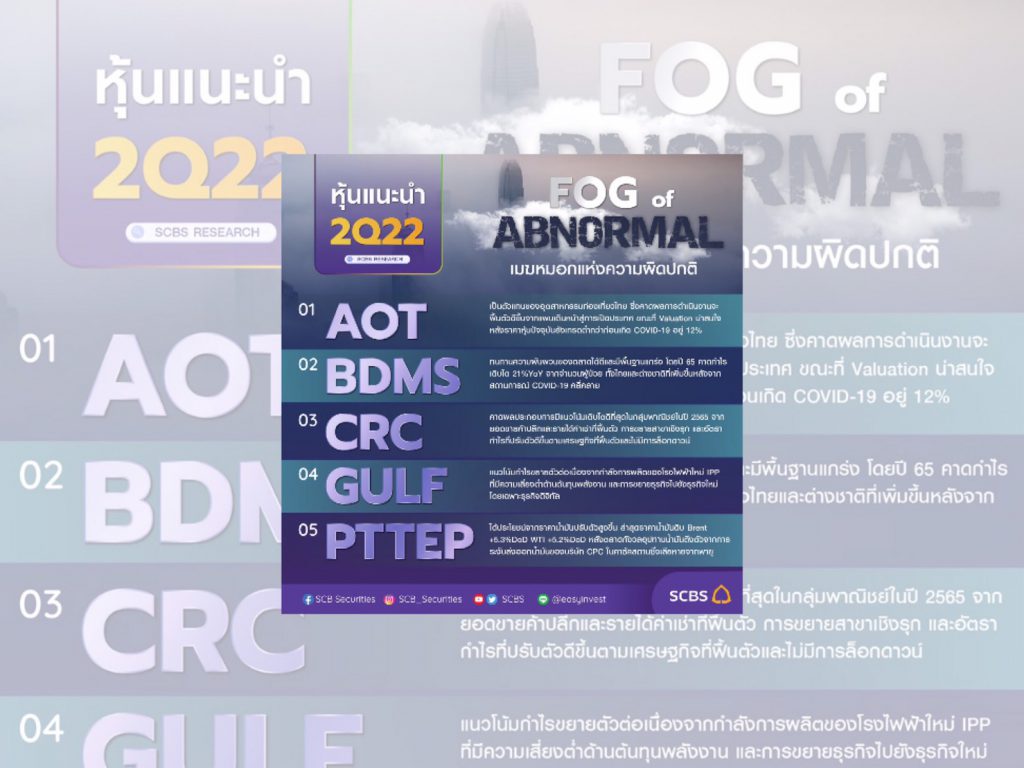

According to the 2022 outlook, investment strategies should prioritize the following macro and micro themes: 1) Stocks with strong pricing power (high and stable margins); 2) Stocks that benefit from the country’s reopening; 3) Reasonably priced growth stocks; and 4) Quality stocks. Investors are advised to place greater emphasis on passive stocks as a precautionary measure while the level of uncertainty remains high. Domestic stocks with strong pricing power and balance sheets are expected to attract more attention than those that are dependent on global economic cycles, which are more susceptible to global economic slowdowns than domestic stocks. Additionally, investors should prioritize stocks that are resilient to rising oil prices and inflation. AOT, BDMS, CRC, GULF, and PTTEP are the top performing stocks in 2Q22.

Summary of investment issues for individual stocks:

AOT: The company represents the Thai tourism industry, and its performance is expected to improve as a result of the country’s reopening plans. Additionally, the valuation is attractive, as the current share price is still 13% lower than it was prior to the COVID-19 outbreak.

BDMS: The company has weathered market volatility on the strength of its fundamentals, with profits expected to grow 21% YoY in 2025 as the number of patients, both Thai and foreign, increases following the conclusion of the COVID-19 situation.

CRC: Earnings are expected to grow at the fastest rate in the commercial sector in 2022, owing to recovering retail sales, rental income, proactive branch expansion, and improved profit margins as the economy recovers without lockdowns.

GULF: The company’s profit outlook will continue to improve as a result of new IPP capacity, with lower risk of energy costs and expansion into new businesses, particularly digital businesses.

PTTEP: The company will benefit from rising oil prices, with Brent crude oil prices +5.3% DoD and WTI crude oil prices +5.2% DoD following market concerns about tight oil supply following Kazakhstan CPC’s suspension of oil exports due to a storm.