SCB EIC views the manufacturing sector as dragging down the Thai economy

Structural headwinds in manufacturing sector to weigh on the long-term trend of the Thai economy. SCB EIC expects two rate cuts by the first half of 2024.

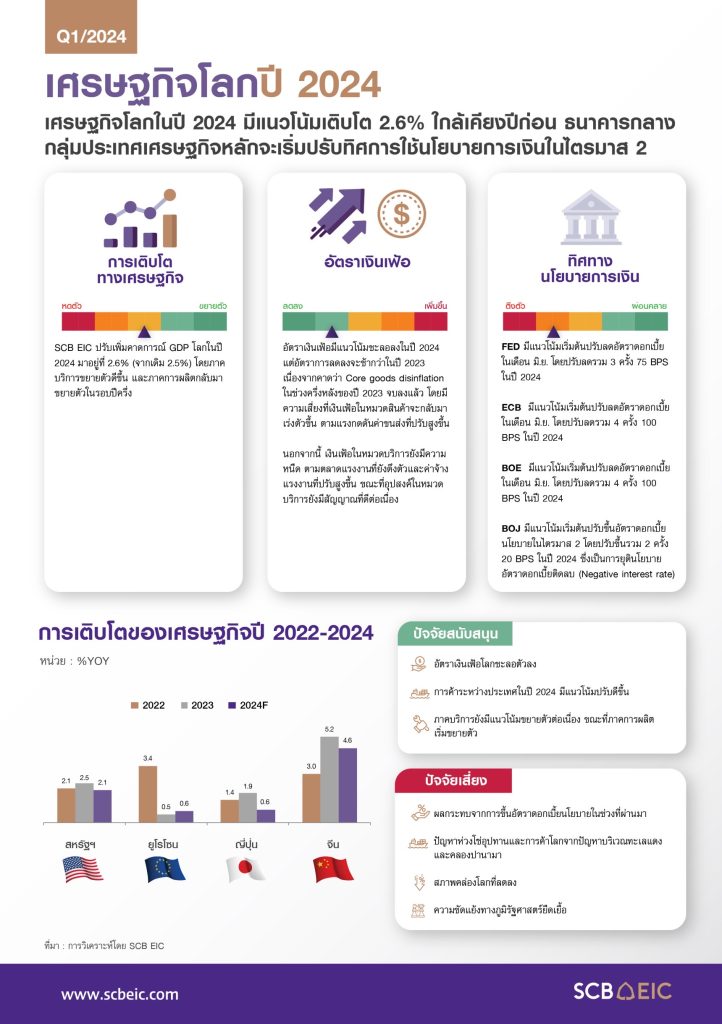

SCB EIC expects the global economy to expand by 2.6% in 2024, close to the 2023 reading. The overall outlook has improved thanks to enhanced momentum observed in Q4/2023 and upbeat economic activities in early 2024. Notably, activities in the service sector exhibited firm growth, while the manufacturing activities showed signs of rebound from a prolonged period of contraction. On top of that, the global economy is poised to gain impetus from more favorable global trade and subsiding inflationary pressures. Nonetheless, there remain headwinds, including high interest rates, ongoing geopolitical tensions, and global supply chain disruptions triggered by the Red Sea crisis and severe drought in the Panama Canal.

Central banks in major economies will start to pivot their monetary policy directions in Q2/2024. The US Federal Reserve is likely to make three policy rate cuts (totaling 75 bps) this year, whereas the European Central Bank and the Bank of England may lower policy rate four times (100 bps) on the back of an inflation cooldown. In contrast, the Bank of Japan is expected to hike its ultra-low policy rate twice (20 bps), ending the long era of negative interest rates. Lastly, the People’s Bank of China will stay the course on an accommodative stance to support the flagging economy.

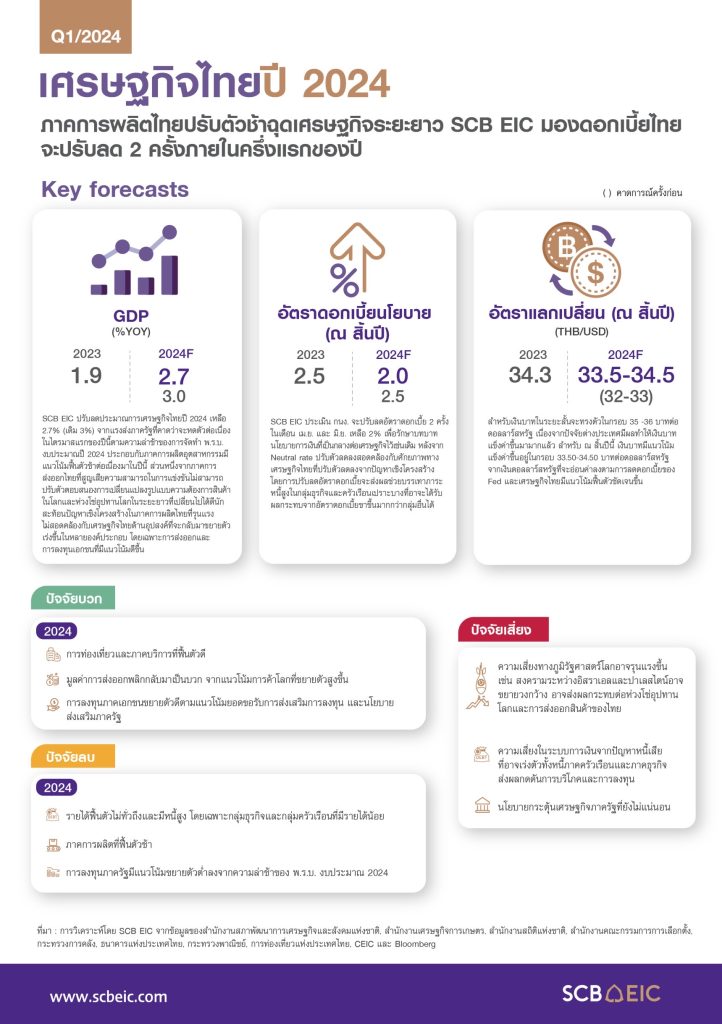

As for the Thai economy, SCB EIC revised down our growth forecast for 2024 to 2.7% (from 3%), despite an overall outlook showing signs of a steady rebound. On a positive front, Thailand’s economy should gather momentum backed by promising prospects in tourism, robust performance in the service sector, and a resumption in demand-driven economic activities—driven by exports and private investment. Nevertheless, we expect a continued contraction in public spending in Q1/2024 owing to the delayed enactment of 2024 budget bill. Inventory accumulation is likely to remain high and also poses another challenge to an overall economic outlook. This is partly attributed to structural issues in Thailand’s manufacturing sector, particularly concerning in export competitiveness. Addressing such challenges will be crucial to facilitating a recovery in Thailand’s industrial sector this year.

Despite several months of negative inflation, SCB EIC assesses that Thailand has yet to enter a recession. We anticipate inflation returning to positive territory in May, following the withdrawal of energy subsidies and a subsequent increase in domestic oil prices. Apart from that, upside risks remain from the global supply chain disruption aggravated by the Red Sea dispute, the climate crisis, and export controls imposed by some trading partners—which could potentially entail price surges in agricultural products such as rice and sugar. As a result, the headline inflation should rebound to the target range in 2H/2024. We forecast Thailand’s headline and core inflation for 2024 at 0.8% and 0.6%, respectively.

Structural challenges in manufacturing sector will further deteriorate Thailand’s long-term economic potential. Based on SCB EIC assessment, Thailand’s economic growth potential stood at 3.4% before the COVID-19 pandemic (2017-2019) but will recede to 2.7% in the long term (downgraded from 3% in the Dec 2023 assessment), underscoring a downtrend of long-term economic growth. These structural headwinds stem from 1) Wosening total factor productivity due to lower labor productivity and regulatory hurdles doing businesses; 2) Declining capital as shown by domestic investment decreasing by half to only 24% of GDP over the past two decades along with lower FDI attractiveness compared to ASEAN peers; and 3) Shrinking labor force, attributed to Thailand’s rapidly aging population.

SCB EIC expects the Monetary Policy Committee (MPC) to gradually lower the policy rate from 2.5% to 2% within 1H/2024 to maintain a neutral stance of monetary policy This follows the recalibration of monetary policy mechanism in response to escalating structural headwinds in manufacturing and the reassessment of Thailand’s long-term neutral rate. Our assessment shows Thailand’s neutral rate has been lower to 2.1% (from the previous estimate of 2.5%). The anticipated rate cuts will not only provide room for the MPC to appropriately readjust monetary policy stance in line with structural change in the Thai economy. But, it will also alleviate the debt burden, particularly for vulnerable firms and households whose exposures mounting from high interest rates. The rate cuts will also shore up economic sentiment amidst subdued government spending this year. In the short term, the Thai baht will stabilize within the range of 35-36 baht per USD as external factors have already driven the previous baht appreciation. We anticipated the Thai baht strengthening to 33.50-34.50 baht per USD at the year-end, attributed to the weakening US dollar following the Fed’s rate cuts and improved outlook for Thailand’s economy.

Looking ahead, Thailand will confront with substantial challenges from structural issues in the manufacturing sector. While manufacturing is expected to regain in 2024 thanks to buoyant domestic and external demand for consumer goods, the industry continues to rely heavily on traditional supply chains. Thai economy is also intricately linked to China—notably the Chinese manufacturing supply chain—contrary to the shifting geopolitical landscapes. Apart from that, the sectoral capabilities to adapt themselves towards modern supply chains and evolving global demand have been slow. These challenges have hindered Thailand’s export competitiveness, reflecting by the stagnant export share of global exports over the past decade.

Therefore, it is urgent for Thailand’s manufacturing sector to keep up with emerging sustainability trends, enhance technological development, and bolster resiliency in supply chain management. These efforts are essential for Thailand to participate with and strengthen its footing in the modern global supply chain.