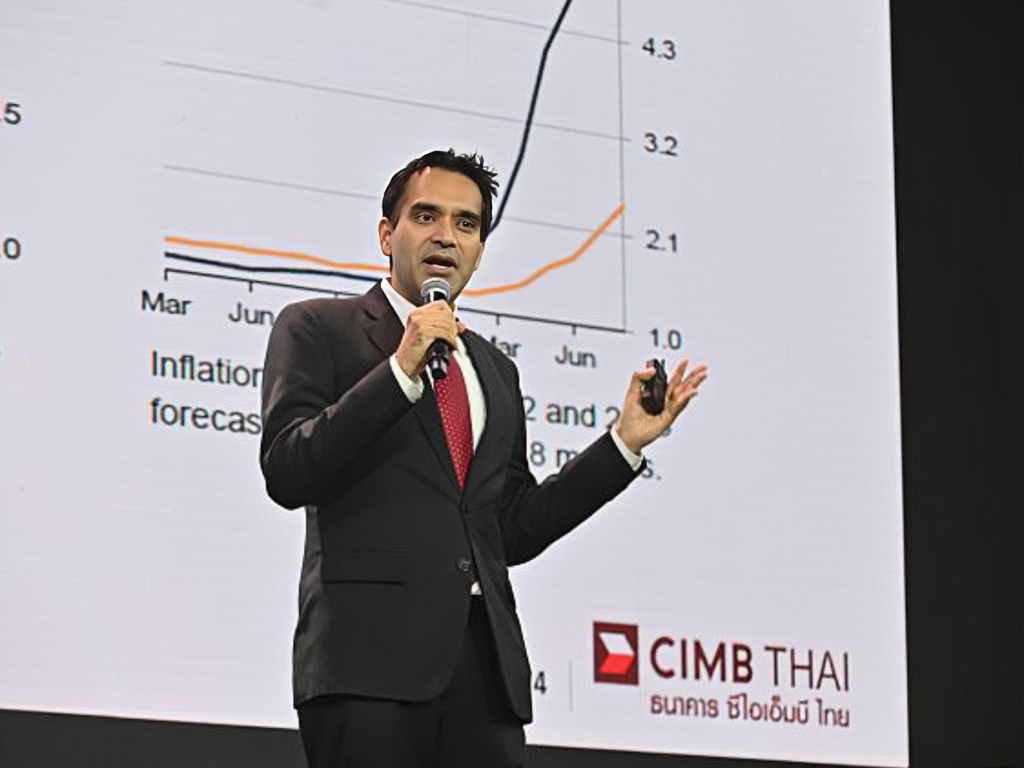

CIMB Thai adjusts 2024 GDP growth forecast to 2.3% from 3.1%

Amontthep Chawala, Head, Research of CIMB Thai stated that The downward adjustment in GDP growth forecast is attributed to several key factors.

A significant slowdown in the fourth quarter of 2023 has dampened economic momentum. Moreover, delays in budget disbursement and a lack of public investment are expected to further impact economic activities negatively, especially during the first half of 2024. Household spending is showing signs of softening, influenced by weak farm income and a slowdown in manufacturing employment. Although a recent government stimulus aimed at easing tax receipts has temporarily boosted service and non-durable goods spending, it is likely insufficient to offset the impact of weakened income.

Thailand’s 2024 Economic Navigator: Rate Cuts as a Temporary Remedy for Declining Growth Potential Amid Structural Challenges

Thailand’s 2024 Economic Navigator

Research, CIMB Thai has carefully reviewed the latest economic indicators, policy changes, and global economic trends to revise Thailand’s GDP growth forecast for 2024. Due to a noticeable slowdown in Q4 2023, combined with delayed budget disbursement and insufficient public investment, we have adjusted the growth projection from 3.1% to 2.3%.

GDP Growth Forecast Revision:

The downward adjustment in GDP growth forecast is attributed to several key factors. A significant slowdown in the fourth quarter of 2023 has dampened economic momentum. Moreover, delays in budget disbursement and a lack of public investment are expected to further impact economic activities negatively, especially during the first half of 2024. Household spending is showing signs of softening, influenced by weak farm income and a slowdown in manufacturing employment. Although a recent government stimulus aimed at easing tax receipts has temporarily boosted service and non-durable goods spending, it is likely insufficient to offset the impact of weakened income.

Fiscal drag: government spending and especially public investment has sharply declined, mainly due to delayed budget till April 2024

Weak household spending: private consumption could drop in line with weak farm income and manufacturing wage amid high household debt. Tourism revenue is seen to stimulate higher growth and income distribution by 2H

Poorer outlook on external demand: export recovery is seen slower than what we expected while Thailand’s exports of HDD (sharply declined) showed that Thailand would not benefit much from the recovery of E&E cycle.

We expected a strong recovery during 2H due to budget passing by April, stronger tourism revenue and rate cuts to stimulate household spending

Sectoral Performance:

Manufacturing production continues to contract, hindered by the slow recovery of external demand and high inventory run-downs. Nevertheless, there are positive signs, such as improving exports and an increase in machinery and parts imports, indicating potential recovery in the manufacturing sector. Construction is anticipated to hamper growth in the first half of the year, primarily due to the delayed budget and lack of new infrastructure investments. Conversely, the service sector, particularly tourism-related services, is expected to see expansion, bolstered by increasing tourist arrivals, which in turn supports wholesale, retail, transportation, and the hospitality industry.

Interest Rate Outlook:

We maintain our forecast for two rate cuts of 25 basis points (bps) each, expecting the interest rate to fall from 2.50% to 2.00% by the end of the year. Given the softer-than-anticipated economic performance, the first rate cut is now projected for the April meeting, moved up from August. These rate cuts aim to mitigate the impact of low purchasing power due to delayed budget disbursement. However, we do not foresee these adjustments enabling the economy to surpass the 3% growth threshold, as Thailand continues to face structural challenges.

“Overflowing Dam Water” … Beware the Consequences of Interest Rate Policy Reduction

We want to compare or reflect on monetary policy, particularly decisions to cut policy rates, to warn of the pressure that may arise after the first interest rate cut, which is expected to occur on April 10th. This is akin to opening the floodgates, allowing water to flow freely and uncontrollably. Whenever the central bank decides to cut rates, it may be seen as opening the door to a more relaxed financial condition. Additionally, it may further stimulate expectations within the financial market or induce participants in the money and capital markets to engage in activities that push interest rates lower or have side effects on exchange rates and economic stability, unintentionally and uncontrollably. It’s like water flowing through an open door that cannot be reversed to flow back.

The implementation of monetary policy is crucial and requires careful consideration and foresight, emphasizing that initial decisions can stimulate continuous responses that may shape market directions in profound and often irreversible ways.

However, we believe that the Bank of Thailand (BoT) should cut interest rates twice this year to 2.00%, not only to support the slow-growing Thai economy and low inflation in the first half of the year but also to respond to long-term economic trends in Thailand for declining growth potential. Structural economic problems such as investment shortages, skilled labor shortages, and an aging society are not conducive to high interest rates in the long run. While we expect short-term economic issues cannot be solved solely through monetary policy, but rather rely on fiscal policy leadership, the overall Thai economy is expected to accelerate after the government’s budget stimulus in April, and interest rate policy may return to the backseat unless financial markets pressure banks to further reduce interest rates.

We must be cautious about the side effects, especially if Thailand cuts interest rates before the United States, causing assets denominated in baht to lose attractiveness, resulting in capital outflows, a weaker baht affecting importers, and increased household expenditure, particularly on oil. Although exporters and the tourism sector may benefit, it’s difficult to gauge whether continuous interest rate cuts will be worthwhile, and we must be prepared to assess whether we gain or lose from this round of interest rate reduction.

Exchange Rate Projections:

A significant revision in our outlook concerns the Thai baht’s exchange rate, now forecasted to weaken to 37.00 baht per US dollar by year-end 2024, from a previous estimate of 33.50. This adjustment reflects anticipated shifts in U.S. monetary policy and its impact on capital flows and currency valuations in emerging Asian economies.

Economic Challenges and Opportunities:

Looking ahead, the first half of 2024 is expected to exhibit stagnant growth due to weakened household spending, private investment, and delayed budget spending. However, the latter half of the year may witness accelerated growth, driven by increased government spending on public investment. Financial stability remains a priority, with the Bank of Thailand (BOT) likely to approach interest rate cuts cautiously. Geopolitical tensions, particularly between the U.S. and China, pose a significant risk to Thailand’s economic recovery.

Conclusion:

Despite the near-term challenges, there are signs of potential recovery in Thailand’s economy, particularly in the export and tourism sectors. The government’s fiscal and monetary policy responses will be crucial in mitigating the impacts of current economic weaknesses and supporting a more robust recovery in the second half of 2024. Our analysis underscores the importance of addressing structural issues to enhance Thailand’s long-term economic potential and resilience.