EXIM Thailand Responds to Ministry of Finance Policy

EXIM Thailand Responds to Ministry of Finance Policy by Maintaining Unchanged Prime Rates Until the End of 2023

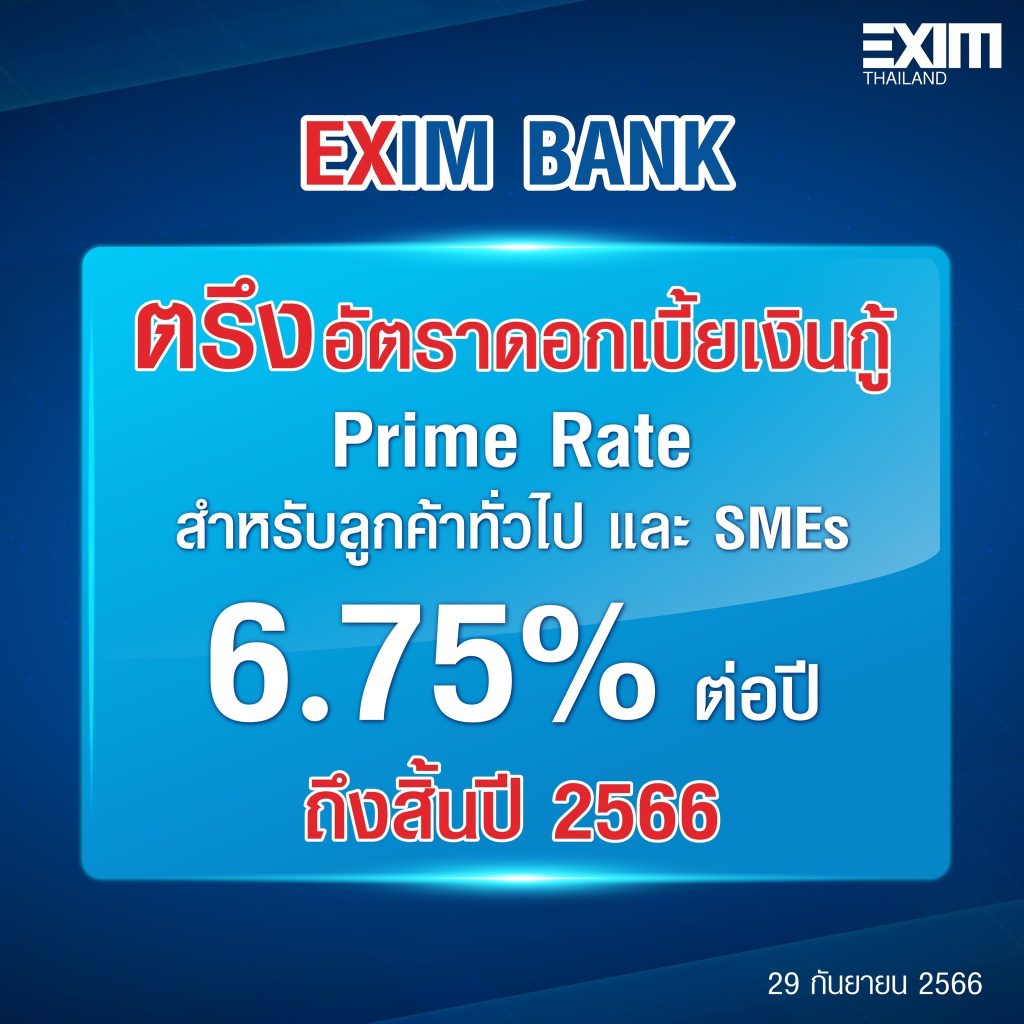

Dr. Rak Vorrakitpokatorn, President of Export-Import Bank of Thailand (EXIM Thailand), disclosed that in accordance with the resolution of the Monetary Policy Committee, the most recent policy rate has been adjusted with an annual increase of 0.25%, rising from 2.25% to 2.50% per annum, effective immediately on September 27, 2023. This adjustment was prompted by the overall economic recovery in Thailand, alongside the anticipated expansion of the Thai economy in 2024, driven by both domestic and international factors, including the upward trend of inflation rate, aligning with the broader economic recovery. In response to Ministry of Finances policy, EXIM Thailand has affirmed its commitment to maintaining its Prime Rate (lending interest rate applicable to general customers and SMEs at 6.75% per annum until the end of 2023. This initiative is aimed at assisting and lightening the financial burden on business and investment operators, including SMEs, during a period of economic recovery.

“As a specialized financial institution, EXIM Thailand remains resolute in its role as the Thailand Development Bank, with a firm determination to support both general customers and SME entrepreneurs by keeping interest rates unchanged. We are also actively advancing the development of financial products and tools to enhance business adaptability, enabling them to initiate or expand their ventures in the global market. This, in turn, will generate income, stimulate employment, foster economic growth within local communities and Thailand as a whole, and contribute to sustainable development amidst fluctuating economic conditions and rising interest rates,” said Dr. Rak.