SCB CIO advises clients to take advantage of short-term US dollar

The baht is currently under pressure to depreciate as the US Fed continues to increase interest rates and the SCB CIO forecasts US dollar appreciation in the near term. The SCB CIO therefore suggests that investors take advantage of this opportunity to diversify their offshore investment portfolios with US dollars in order to increase the likelihood of earning more desirable returns than investing only onshore.

Deposits, two varieties of structured notes, and mutual funds that do not hedge against exchange rate risk are four SCB products recommended to satisfy the needs of investors across a range of risk aversions.

Siam Commercial Bank Executive Vice President and Chief Investment Office and Product Function (SCB CIO), Sornchai Suneta revealed that the US dollar is expected to appreciate in the short term as a result of the US Federal Reserve’s (Fed) signaling that it will continue to increase interest rates to control inflation. The SCB CIO predicts that the Federal Reserve will raise interest rates for a final time in May, bringing the US terminal rate for this year to 5.25%. After this hike, the US dollar could reverse and begin to depreciate again over the medium to long term, expected to be more than six months.

The dollar’s short-term appreciation is one of the factors contributing to the baht’s short-term depreciation, along with Thailand’s modest current account surplus. Typically, the current account correlates with and moves in tandem with the baht. The value of the baht rises when there is a surplus in the current account and falls when there is a deficit.

However, in the medium and long term, Thailand’s current account balance surplus is likely to grow as the number of tourists continues to recover, particularly after China reopens its borders. The SCB EIC, for instance, has upped its estimate for international visitors in 2023 to 30 million from 28.3 million and believes that the number of international visitors will recover to the pre-COVID level by late 2024. To that end, the SCB CIO believes the baht will recover and strengthen, reaching a rate of 33 to 34 baht to the US dollar by the end of 2023.

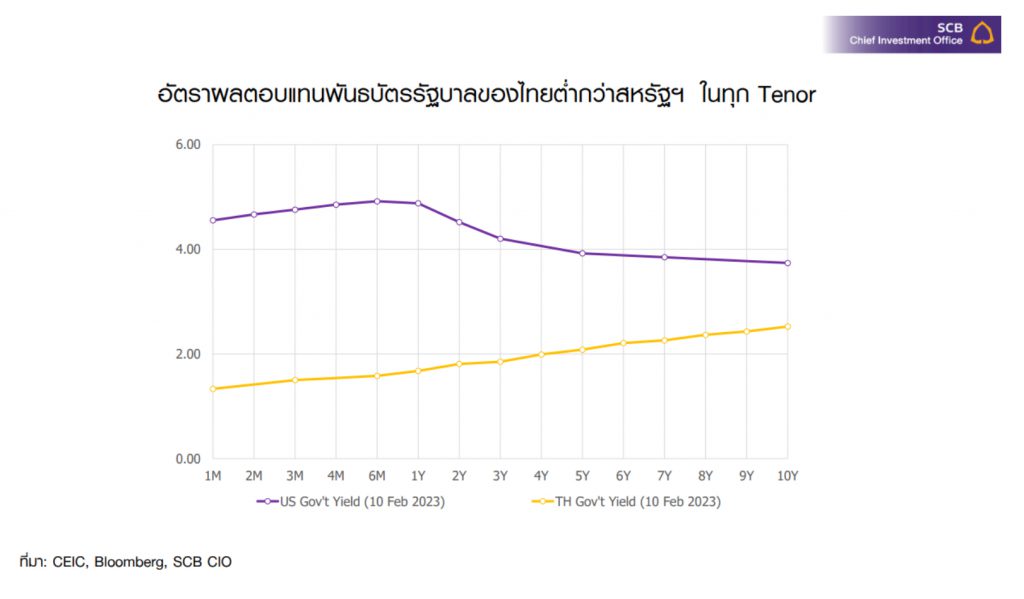

“In the short term, the baht will be under pressure to depreciate as the US currency continues to strengthen. The SCB CIO believes that If the baht isn’t weaker than 35 baht per US dollar this will present an excellent situation to exchange Thai baht to US dollars for diversifying a portion of any portfolio offshore using US dollars because doing so will yield higher returns than investing solely onshore. Yields on US treasuries, which were elevated in February 2023 to a risk-free rate, were significantly higher than those for Thai government bonds. In particular, US treasuries with maturities between one month and one year yield approximately 4-5%, whereas Thai treasuries with the same tenure range only provide returns at a level lower than 2%,” noted Sornchai.

When it comes to investing in US dollars while the currency is appreciating, Siam Commercial Bank has a broad variety of products to choose from. There are essentially four categories of interesting products:

Foreign Currency Deposits (FCD) are deposit accounts for individuals or legal entities who wish to deposit funds in foreign currencies like U.S. dollars, Eurodollars, or other foreign currencies. Investors will earn US currency interest on deposits made in US dollars. Therefore, this is a good option for those who plan to invest overseas or keep their foreign currency for future investments.

US dollar Capped Floored Floaters are financial instruments that offer returns based on the Secured Overnight Financing Rate (SOFR), using the daily SOFR to calculate interest with the compound average method. If the average SOFR over the previous three months was 4% or higher, the instrument’s return will be 4%. If the SOFR is below 3.75%, the instrument’s minimum yield over a three-month period will be 3.75 percent. The product pays interest and principal in US dollars and features a unique reward structure.

Dual Currency Investment (DCI) is another form of structured notes with a short-term maturity, such as one month, with a predetermined target exchange rate. If the bond is held until maturity and the exchange rate is as arranged, such as a baht appreciation reaching the agreed rate, it will be converted into US dollars at the agreed exchange rate. However, investors will receive returns of principal and interest in baht currency if the baht is weaker than the target exchange rate. This instrument is ideal for investors seeking to exchange dollars.

The SCB Foreign Short-Term Fixed Income Fund (SCBFST) is a non-hedged investment choice that invests in foreign currency denominated short-term bonds. With this tool, buyers can profit from both portfolio returns and currency rate fluctuations. The fund is classified as a category 4 risk, which is between moderate and low.

Disclaimers:

The SCB Foreign Short-Term Fixed Income Fund (SCBFST) is classified as having a medium to low level of risk, or risk level 4.

Investors may incur foreign exchange losses or gains or receive a refund that is less than the initial investment for funds with exchange rate risks that are not fully hedged.

Structured notes are more complicated than regular bonds because they are comprised of debt instruments with derivatives. Investing in structured debentures involves a variety of risks, including the risk of underlying factors and the credit risk of the issuer, among others.

Before investing, investors should understand the conditions for receiving returns and the associated risks and seek additional advice from business operators.

Investments in structured notes are not protected by the Deposit Protection Agency because they are not deposits. Therefore, there is a possibility that investors will not receive the full amount of their investment back, and redemption is subject to the terms of the investment product as specified in the prospectus.

Before investing, investors should understand the characteristics, return conditions, and risk of structured notes.

Past performance is not indicative of future results.

The website of SCB Asset Management Co., Ltd. contains information on the master fund and mutual fund prospectus.