The Thai Economy in Q3/2022 and the Outlook for 2022 – 2023

The Office of the National Economic and Social Development Council (NESDC) announced the Thai Gross Domestic Product (GDP) in the third quarter of 2022 and the economic projection for 2022 – 2023 as follows:

The Thai Economy in Q3/2022

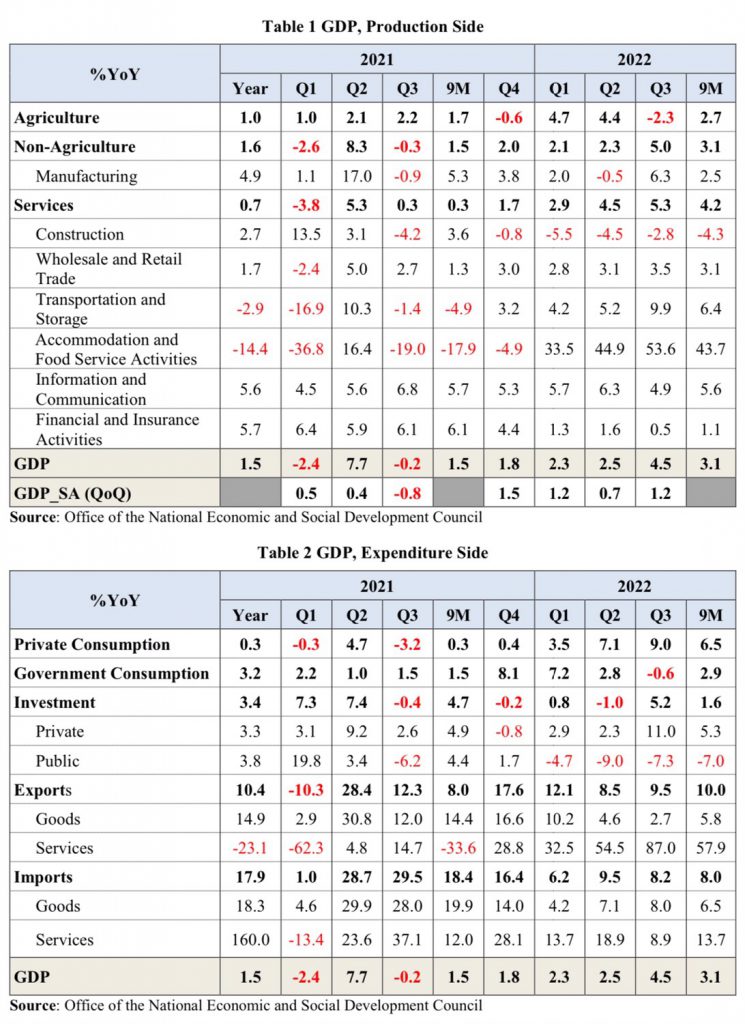

The Thai Economy in the third quarter of 2022 expanded by 4.5 percent, accelerating from 2.3 percent and 2.5 percent in the first and second quarters respectively. After seasonal adjustment, the economy increased by 1.2 percent from the second quarter (%QoQ sa). In the first 9 months of 2022, the Thai economy grew by 3.1 percent.

On expenditure side: private consumption expenditures, public investment and export of services accelerated. Export of goods slowed down, while government expenditure and investment decreased.

Private consumption expenditures expanded by 9.0 percent, accelerating from 3.5 percent and 7.1 percent in the first quarter, and second quarter, respectively. This was the highest growth in 39 quarters following the expansion in all categories. Expenditure in services increased by 15.8 percent, accelerating from a 14.1-percent growth in the previous quarter, following the strong growth of spending on hotels & restaurants and recreation & culture. Expenditure in durable goods increased by 18.2 percent, accelerating from a 3.5-percent expansion in the previous quarter, in line with an expansion of purchase of vehicles. Expenditure in non-durable goods increased by 3.2 percent, slightly increasing from

a 2.7-percent growth in the previous quarter, following the accelerated growth on food and non-alcoholic beverages. Meanwhile, expenditure in semi-durable goods increased by 3.6 percent, increasing from 1.9 percent in the previous quarter, in line with an expansion of spending on furnishings & households’ equipment and clothing & footwear. The satisfactory growth was also in line with an increase in the consumer confidence index towards

the economic situation to 37.6 in this quarter from 34.9 in the previous quarter.

In the first nine months of 2022, private consumption expenditures expanded by 6.5 percent. Government consumption expenditure registered a contraction of 0.6 percent, compared with a 2.8-percent growth in the previous quarter. This was the first negative growth in 10 quarters due to a decrease in purchases of goods and services, specifically in COVID-19 healthcare expenditure. Similarly, the in-kind social transfers declined by 9.9 percent, compared with a 17.0-percent growth in the previous quarter. However, compensation of employees (wage and salary) increased by 1.6. The disbursement rate of the current budget stood at 21.4 percent of the total budget framework (lower than 22.5 percent in previous quarter, and 23.8 percent in the same quarter in 2021). In the first nine months of 2022, government consumption expenditure expanded by 2.9 percent.

Total investment increased by 5.2 percent, compared with a 1.0-percent decrease in the previous quarter. This was mainly due to an expansion in private investment which showed a robust growth of 11.0 percent, accelerating from 2.3 percent in the previous quarter. This was in line with investment in machinery and equipment that increased by 13.9 percent, while investment in constructionreturned to expand by 2.0 percent, compared with a 1.3-percent drop in the previous quarter. Nonetheless, public investment decreased for three consecutive quarters by 7.3 percent, comparing with a 9.0-percent contraction in the previous quarter. The government investment decreased by 11.8 percent; however, the investment of state-owned enterprises (SOEs) grew by 1.1 percent. The disbursement rate of capital budget in this quarter was 21.2 percent of the total budget framework, higher than a 19.2 percent in the previous quarter but lower than 24.0 percent in same quarter of last year. In the first nine months of 2022, total investment grew by 1.6 percent. Thus, private investment expanded by 5.3 percent, while public investment decreased by 7.0 percent.

On foreign trade, export value in the third quarter was recorded at 71.98 billion USD, demonstrating a 6.7-percent growth slowing down from 9.7 percent in the previous quarter. The export volume index and the export price grew by 2.1 percent, and 4.4 percent, compared with 4.4 percent and 5.1 percent in the previous quarter, respectively. Export items with increased value were machinery & equipment (10.3 percent), pick up and trucks (12.8 percent), integrated circuits & parts (11.6 percent), parts of electrical appliances (13.6 percent), medicinal and surgical equipment (9.9 percent), animal food (22.0 percent), sugar (121.4 percent), rice (12.4 percent), and rubber (0.2 percent). On the other hand, export items with decreased value included passenger cars (-7.2 percent), chemicals and petrochemical products (-8.8 percent), computer parts and accessories (-13.2 percent), rubber products (-8.0 percent), durians (-53.0), and other fruits (-39.4 percent). Exports to the main markets continually expanded, while exports to China, Japan and Hong Kong fell. Excluding unwrought gold, export value expanded by 6.4 percent, and in Baht terms, export value grew by 18.1 percent in this quarter. Import value in the third quarter was recorded at 71.558 billion USD, increasing by 23.2 percent accelerating from 22.4 percent in the previous quarter. Import volume and price indices rose by 8.0 percent and 14.1 percent, respectively. Consequently, trade balance recorded a surplus of 0.4 billion US dollars (or 17.1 billion Baht). In the first nine months of 2022, export value stood at 219.791 billion US dollars, a 10.2-percent expansion, while import value was recorded at 204.917 billion US dollars, a 20.7-percent growth. Consequently, trade balance recorded a surplus of 14.9 billion US dollars (or 502.1 billion Baht).

On the production side, manufacturing sector returned to expansion, while accommodation and food service activities sector, wholesale and retail trade; repair of motor vehicles and motorcycles sector, the transportation and storage sector, and the electricity, gas, stream, and air conditioning supply sector accelerated. On the contrary, construction sector and agricultural sector decreased. Agriculture, forestry, and fishing sector decrease by 2.3 percent due to the flood impacts in many agricultural areas and unfavorable weather condition. Major agricultural products with production contraction included fruits (-26.3 percent), rubber (-1.4 percent), swine (-2.2 percent), and cassava (-3.1 percent). Major agricultural products with production expansion included paddy (10.9 percent), oil palm (9.4 percent), maize (8.6 percent), and poultry (1.0 percent). Agricultural Price Index rose by 20.1percent, following an increasing price of main agricultural products such as swine (50.4 percent), fruits (28.4 percent), paddy (20.1 percent), poultry (40.1 percent) and cassava (32.6 percent). Nevertheless, some major agricultural products have their price index contracted, including oil palm (9.8 percent). Rising in agricultural price index led to an increase in farmer income index for the third-consecutive quarters by 17.7 percent. In the first three quarters of 2022, the agriculture, forestry, and fishing sector expanded by 2.7 percent, increasing from 1.7 percent in the same period of the previous year. Agricultural production index increased by 2.8 percent, price index increased by 11.2 percent, and hence farm income index expanded by 14.4 percent.

Manufacturing sector expanded by 6.3 percent, compared with a 0.5-percent contraction in the previous quarter with an expansion in most of the manufacturing sector. This was also in line with an 8.1-percent increase in the Manufacturing Production Index. Manufacturing Production Index of the industries (with 30 – 60 percent export share to total production), sharply surged by 22.8 percent, picking up from a 0.1 percent decrease in the previous quarter. Manufacturing Production Index of the domestic-oriented industries (with export share of less than 30 percent to total production) increased by 4.5 percent, compared with a 0.3 percent contraction in the previous quarter. Manufacturing Production Index of the export-oriented industries (with export share of more than 60 percent to total production) rose by 1.2 percent, recovering from a 2.0-percent drop in the previous quarter. The average capacity utilization rate for this quarter was at 62.55 percent, improving from 61.10 percent in the previous quarter, and 58.51 percent in the same quarter of the previous year. Manufacturing production index with positive growth included motor vehicles (36.1 percent), refined petroleum products (17.3 percent), and sugar (46.1 percent). Besides, manufacturing production index with negative growth included computer and peripheral equipment (-32.4 percent), basic iron and steel (-12.7 percent), and plastics and synthetic rubber in primary forms (-10.9 percent). In the first three quarters of 2022, manufacturing sector increased by 2.5 percent, compared with a 5.3-percent growth in the same quarter of the previous year. This was in line with a 2.8-percent growth in manufacturing production index while the average capacity utilization rate was at 63.40 percent.

Accommodation and food service activities sector continued to increase for three consecutive quarters by 53.6 percent, accelerating from 44.9 percent in the previous quarter, following the improvement in domestic tourism and the significant increased number of international tourist arrivals. In the third quarter of 2022, the number of international tourist arrivals stood at 3.608 million tourists. This mainly owed to a lift in Thai international travel restriction and normalizing conditions of international traveling. Besides, Thai tourism receipts stood at 0.158 trillion Baht, increasing for three consecutive quarters by 1,497.1 percent due to the relaxation of COVID-19 containment measures and the government’s measures to stimulate domestic tourism. The average occupancy rate was at 47.80 percent, increasing from 42.09 percent in the previous quarter, and 5.46 percent in the same period last year. In the first three quarters of 2022, accommodation and food service activities sector favorably expanded by 43.7 percent, improving from a 17.9-percent contraction in the same quarter of previous year. The number of foreign tourists stood at 5.688 million persons, increasing by 1,863.1 percent. The average occupancy rate was at 42.02 percent. Wholesale and retail trade; repair of motor vehicles and motorcycles sector increased by 3.5 percent, accelerating from a 3.1-percent growth in the previous quarter, following the improvements of household expenditure and the tourism sector. This was in accordance with an increase in wholesale and retail trade index. In the first three quarters of 2022, wholesale and retail trade sector increased by 3.1 percent, rising from 1.3 percent in the same period of the previous year. Transportation and storage sector grew by 9.9 percent, accelerating from a 5.2-percent expansion in the previous quarter, following the expansions of air transport, land transport, and transport via pipelines. In the first three quarters of 2022, the transportation and storage sector expanded by 6.4 percent, recovering from a 4.9-percent decline in the same period of the previous year.

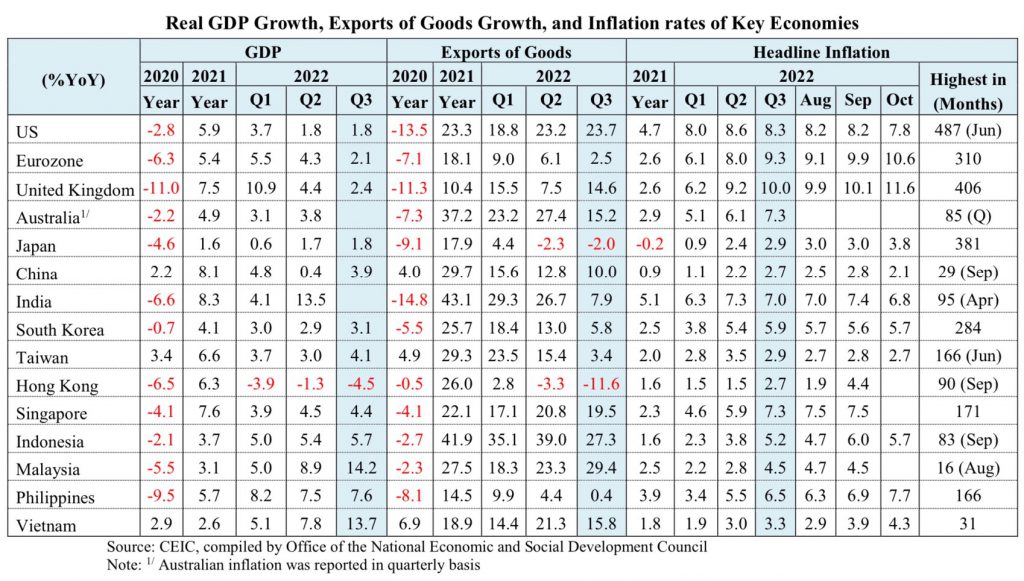

On economic stability, the unemployment rate stood at 1.23 percent, continually declining from 1.37 percent in the preceding quarter and 2.29 percent in the same quarter of 2021. The headline and core inflations were at 7.3 percent and 3.1 percent, respectively. The current account recorded a deficit of 7.0 billion US dollars (253 billion Baht). At the end of September 2022, the international reserves stood at 0.2 trillion US dollars and the public debt was at 10.37 trillion Baht, accounted for 60.7 percent of GDP.

The Thai Economic Outlook for 2022

The Thai economy in 2022 is projected to expand by 3.2 percent, accelerating from 1.5 percent in 2021. Headline inflation is estimated at 6.3 percent and the current account is projected to record a deficit of 3.6 percent of GDP.

The Thai Economic Outlook for 2023

The Thai economy in 2023 is expected to expand within the range of 3.0 – 4.0 percent. The growth will be mainly supported by (i) the recovery of tourism sector, (ii) the expansion of both private and public investments, (iii) the continual expansion of domestic demand, and (iv) the favorable growth of agricultural sector. Consequently, it is expected that private consumption expenditure, private investment, and public investment will increase by 3.0 percent, 2.6 percent, and 2.4 percent, respectively. Export value of goods in US dollar terms is anticipated to expand by 1.0 percent. Meanwhile, the headline inflation is expected to be in a range of 2.5 – 3.5 percent, and the current account tends to register a surplus of 1.1 percent of GDP.

Key growth components include as follows:

Total consumption: (1) Private consumption expenditure is expected to increase by 3.0 percent in 2023, compared with a 5.4-percent growth in 2022, owing to the expansion of income base and the continual recovered in labor market. (2) Government consumption expenditure is projected to drop by 0.1 percent, compared with a 0.2-percent contraction in 2022. This is in line with the assumption of current budget disbursement rate under FY2023 which is 2.48 trillion Baht, decreasing by 1.8 percent from 2.5 trillion Baht in FY2022, and declines in the disbursement under the 1-trillion Baht and 500-billion bath loan decrees.

Total investment is expected to grow by 2.5 percent, compared with 2.6 percent in 2022. (1) Private investment is estimated to increase by 2.6 percent, slowing from a 3.9-percent growth in 2022. This was in accordance with the slowdown in world economy and export sector. (2) Public investment is expected to grow by 2.4 percent, recovering from a 0.7-percent decline in the previous year owing to an increase in capital budget framework under FY2023 which is 695.08 billion Baht, increasing by 13.5 percent from a budget of 612.57 billion Baht in FY2022. Moreover, there is also support from the progress in key infrastructure projects under state-owned enterprises’ investment budget.

Export value of goods in US dollar terms is anticipated to increase by 1.0 percent, compared with a 7.5-percent growth in 2022. The export volume is forecasted to grow by 1.0 percent, decelerating from a growth of 3.2 percent in the previous year, owing to the slowdown of the global economy and merchandized trade. Additionally, the export price is expected to increase within the range of (-0.5) – 0.5 percent, compared with 4.3 percent in 2022. Meanwhile, the export of services is expected to continual improve following increasing numbers of international travelers. Consequently, revenues from foreign tourists in 2023 is projected to be 1.2 trillion Baht, compared with 0.57 trillion Baht in 2022. Thus, in 2023, the export quantity of goods and services is estimated to increase by 8.5 percent, compared with 8.2 percent in 2022.

Economic management for the year 2023

The economic management for the year 2023 needs to prioritize on following issues:

1. Closely monitoring and resolving retail debts amidst the rising interest rate tendency, of both households and small and medium enterprises (SMEs).

2. Supporting agricultural production and farmers’ income, by rehabilitating the flood damaged areas and preparing supporting policy for agricultural products during the cultivation season 2023/24.

3. Maintaining momentum from export sector, by (i) boosting exports to major markets coupled with expanding to new markets with potential products; (ii) monitoring the global economic and trade condition, in order to utilize benefits from economic and trade policies in major economies; (iii) improving quality of agricultural, food, and manufacturing products to achieve international standard; (iv) utilizing benefits from the Regional Comprehensive Economic Partnership (RCEP), along with expediting the ongoing Free Trade Agreement negotiations and endeavoring for future negotiations with new potential trading partners; and (v) encouraging the business sector to appropriately manage risk of exchange rate fluctuation.

4. Catalyzing the recovery in tourism and related service sector, by:

(i) preparing and assisting the tourism sector to be ready for the resuming of foreign tourists; (ii) promoting the development of sustainable and high-quality tourism; (iii) continually supporting the tourism promoting events; and (iv) promoting domestic tourism.

5. Stimulating private investment, by: (i) assisting the liquidity for the business amidst upward interest rate tendency and global economic slowdown; (ii) speeding up projects already approved and obtained investment promotion certificates in 2019-2022 to start their actual investments, especially those in the targeted industries; (iii) solving difficulties and obstacles hindering investors and entrepreneurs from investing and conducting businesses; (iv) implementing proactive investment promotions and facilitating investors in targeted industries to invest in Thailand; (v) stimulating investments in Eastern Economic Corridor (EEC), other special economic zones, as well as the regional economic corridors;(vi) supporting investment in the key economic areas and transport infrastructure to be in accordance with the prospected plan; and (vii) enhancing high-skilled labors.

6. Maintaining growth momentum from public expenditure. (7) Monitoring, scrutinizing, and preparing for the volatilities from global economy and financial market as well as highly uncertain geopolitical risks. (8) Monitoring, scrutinizing, and preparing for the epidemic of the new variants of COVID-19.