EXIM BANK Quarter 2 Net profit 600 million baht

EXIM Thailand Unveils “EXIM Index” Innovation and “EXIM Export Ready Credit” with 4.5% Per Annum Interest Rate in the First 6 Months, Keeps Interest Rate Unchanged to Drive H2/2022 Export, and Celebrates Achievement of 2022 Loan Target within First 7 Months

EXIM Thailand has rolled out its “EXIM Index” which would help assess Thai export directions on a quarterly basis and indicate probability and guidelines to cover international trade risks. The Bank has also announced maintaining of its prime rate at 5.75% p.a. and launched “EXIM Export Ready Credit” offering a maximum credit line of 5 million baht at lowest interest rate of 4.5% per annum in the first 6 months and installment repayment period of not over 3 years to finance entrepreneurs’ enhancement of liquidity in their export and related businesses. EXIM Thailand was in top form again! achieving its 2022 loan target of 156,500 million baht within the first 7 months, and recording a year-on-year increase of over 30% in new loan approvals in the first half of 2022 and a 12.55% year-on-year growth in pre-provision profit. Its NPL ratio stayed at a low level of 2.91% with an NPL coverage ratio of as high as 274.67%.

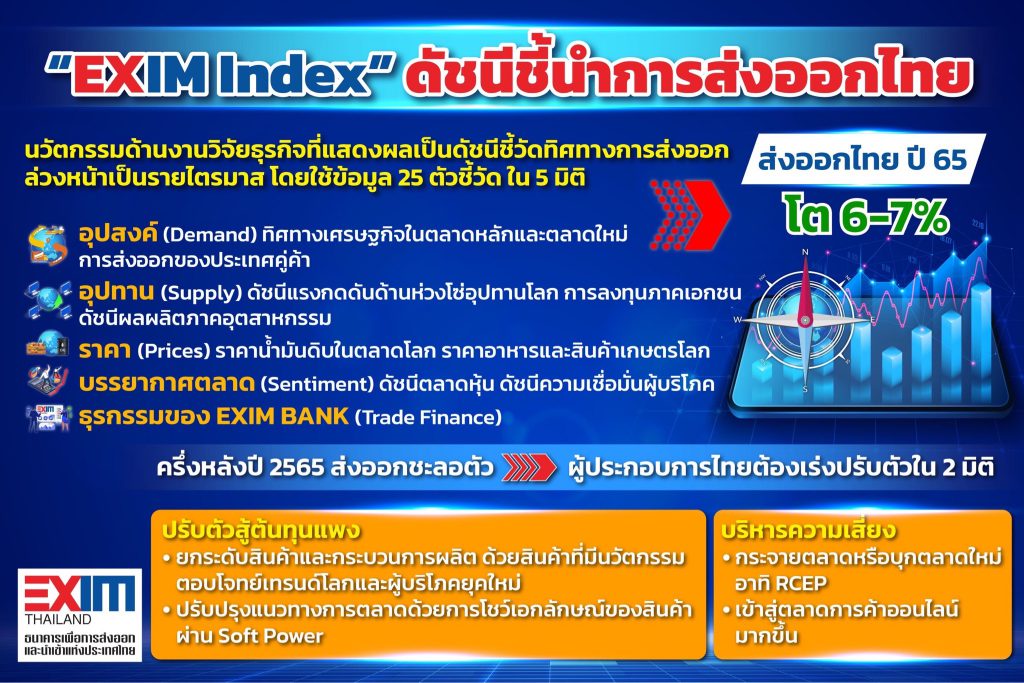

Mr. Rak Vorrakitpokatorn, President of Export-Import Bank of Thailand (EXIM Thailand), revealed that in the second half of 2022, Thai export should continue growing but at a decelerating rate from that of 12.9% in the first 5 months of this year. Year-round export is predicted to expand by 6-7% amid the inflation rate hike which has pushed up prices of goods, as well as business and transportation costs. To assist Thai exporters in keeping pace with the current situations and coping with emerging challenges, EXIM Thailand has initiated “EXIM Index,” a business research innovation that presents forward-looking export prospects based on 25 indicators in five dimensions. The five dimensions are demand: economic prospects of principal markets and new frontiers as well as export conditions of trade partners; supply: pressures from global supply chains, private sector investment and manufacturing production index; prices: global crude oil prices as well as global food and farm prices; market sentiment: from stock market indices and consumer confidence indices of trading partners; and EXIM Thailand trade finance. These have culminated in the “EXIM Index.” As of June 2022, EXIM Index was 100.63, going down slightly from 100.90 in May 2022, which has reflected slowing export trend in line with declining economic outlook of trade partners, for example, the US and Europe, economic recession and inflation spike concern among consumers and investors, as well as prevailing global supply chain disruption which have driven up costs of exporters, and decelerating expansion of trade finance transactions.

EXIM Thailand President said that, Thai entrepreneurs need to make adjustments in two dimensions in the second half of 2022. The first dimension is making adjustments to fight the rising costs by upgrading their products and production processes gearing up for competing in innovative product markets in response to current market trends and demand in consumers of the new era for such products as green, digital, health (GDH) products, and marketing realignment by showcasing product identity, soft-power selling, brand building and storytelling. The second dimension is risk management by way of market diversification or penetration of new frontiers, such as countries under Regional Comprehensive Economic Partnership (RCEP), the world’s largest free-trade agreement (FTA) with a population of more than 2,300 million, tax privileges for Thai exporters, and expansion of online trade to a greater extent on the back of prediction of continued growth of global e-commerce value from 4.9 trillion US dollars in 2021 to 7.4 trillion US dollars in 2025, a frog-leap growth from 3.4 trillion US dollars in 2019 and 4.2 trillion US dollars in 2020, as well as comprehensive risk mitigation.

EXIM Thailand President further said that EXIM Thailand is fully ready to support Thai entrepreneurs in fighting the rising costs and managing risks through the “Hybrid Model: Rejuvenate export against rising costs, Drive investment toward new industries” as follows:

Interest rate maintaining policy with the prime rate kept at 5.75% per annum to relieve cost burden of Thai entrepreneurs.

“EXIM Export Ready Credit” new credit facility with a maximum credit line of 5 million baht, minimum interest rate of 4.5% per annum in the first 6 months, and installment repayment term of not exceeding 3 years for Thai entrepreneurs’ use to boost their liquidity in export and related businesses.

Financial Facilities to support market diversification, upgrading of products in response to global trends with demand for GDH products and domestic and overseas investments, particularly development of infrastructures, and new industries that enhance R&D for Thai goods, such as industries conducive to bio-circular-green (BCG) economy and S-curve industries. EXIM Thailand is well-positioned to support businesses of all sizes throughout Thai export supply chain in linkage with global supply chains.

Risk management tools for international trade and investment, such as export credit insurance to safeguard against non-payment by foreign buyers, investment insurance, and foreign exchange forward contract services.

EXIM Thailand Pavilion, as online trade channel on world leading e-commerce platforms.

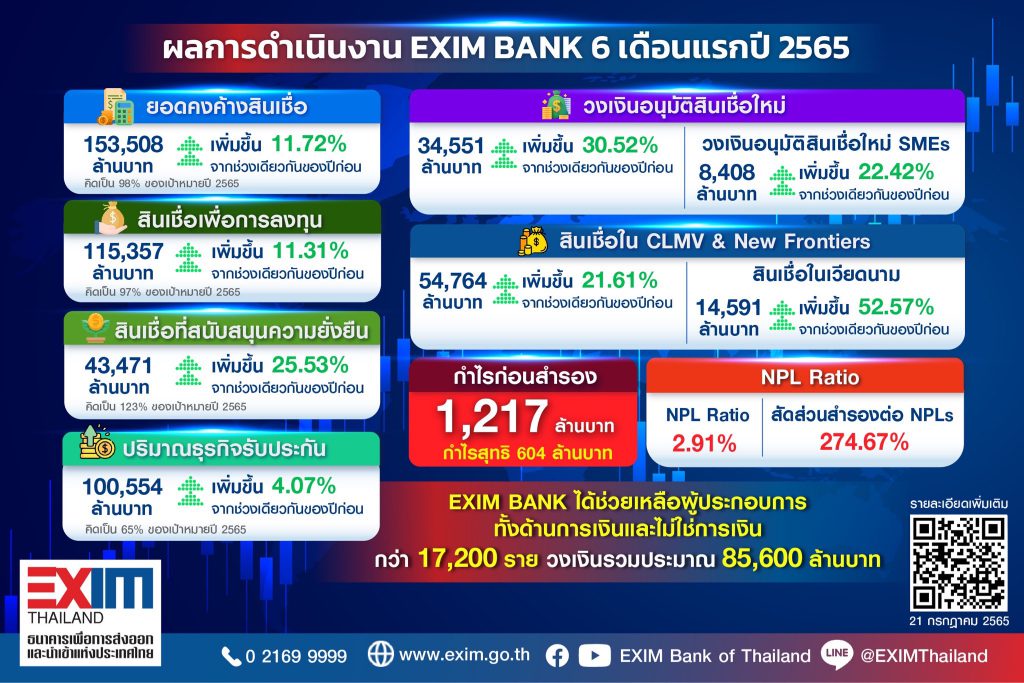

EXIM Thailand President said that, amid the vulnerable situations in 2022, there are still considerable uncertainties in Thai and global economy recovery. However, EXIM Thailand has remained steadfast in supporting Thai entrepreneurs’ adaptation, start-up and expansion of export and investment both at home and abroad. The Bank attained its 2022 outstanding loan target of 156,500 million baht within the first 7 months of the year. In the first half of 2022, it met new loan approval target of 34,551 million baht, up by 30.52% year-on-year, and of which 8,408 million baht was for SMEs, up by 22.42% year-on-year. The Bank has a customer base of 5,476, up by 22.78% year-on-year, and 83.84% of the total customers are SMEs. This has reflected our achievement in supporting the growth of businesses throughout the value chain.

Of the total outstanding loans of 153,508 million baht, as of the end of June 2022, outstanding loans in support of sustainability in line with the government policy to drive BCG economy amounted to 43,471 million baht, a year-on-year growth of as high as 25.53%. Moreover, EXIM Thailand has synergized with a broad range of alliance networks. With the official opening of its representative office in Vietnam in June 2022, the Bank has completely established representative offices in all the four CLMV countries (Cambodia, Lao PDR, Myanmar and Vietnam). As of the end of June 2022, EXIM Thailand recorded total outstanding loans of 66,790 million baht for international projects, a 4,711 million baht or 7.59% growth year-on-year. Classified by principal market, the Bank has still consistently supported Thai entrepreneurs in spreading their wings to cover the CLMV and new frontiers. In the first half of 2022, total outstanding loans to the CLMV and new frontiers amounted to 54,764 million baht, a year-on-year growth of 9,732 million baht or 21.61%. Of this total outstanding loan amount, 14,591 million baht was recorded in Vietnam, constituting a 52.57% year-on-year growth.

EXIM Thailand has built immunity to Thai exporters and investors through provision of insurance facilities. In the first half of 2022, the Bank recorded 100,554 million baht in export credit and investment insurance turnover, a 4.07% year-on-year increase. Meanwhile, news and information as well as advice and seminars and training courses have been made available to consistently uplift Thai entrepreneurs’ potential. As of the end of June 2022, EXIM Thailand financially and non-financially assisted more than 17,200 entrepreneurs, accounting for a total of around 85,600 million baht.

With business operation under efficient organization management, EXIM Thailand has maintained strong financial position. The Bank recorded total NPL amount of 4,471 million baht with NPL ratio of only 2.91% as of the end of June 2022. However, to keep its firm and healthy financial status, the Bank set aside allowance for expected credit loss of 12,281 million baht, contributing to an NPL coverage ratio of as high as 274.67%, highest in the banking system. As a result, in the second quarter of 2022, the Bankposted a pre-provision profit of 1,217 million baht, representing a growth of 12.55% year-on-year and a net profit of 604 million baht.

“As a state-owned specialized financial institution with a mission to drive international trade and investment with robust risk management and resilience, EXIM Thailand is committed to relieve the burden of our customers and Thai entrepreneurs by maintaining the existing prime rate of 5.75% per annum as long as possible in conjunction with rolling out a special promotion campaign which offers the interest rate lower than the prime rate to ensure entrepreneurs, SMEs in particular, would be able to survive and expand their businesses globally. This is certainly a testament to our determination in pursuing our role as Thailand Development Bank tasked to perform beyond banking with development of innovations in provision of financial and non-financial services. We aim to empower Thai entrepreneurs to brave challenges, capture opportunities and deal with emerging risks in the global markets, having EXIM Thailand to walk alongside with Thai entrepreneurs across borders toward sustainable growth of all sectors around the globe in the Next Normal era,” added Mr. Rak.