KBank warns individuals to avoid online

KBank warns individuals to avoid online loan scams using their national ID card; such scams lead victims into a debt trap

Multiple news stories of late involve people who have been tricked by fraudsters into applying for a loan amounting to hundreds of thousands Baht via mobile phone with the use of just their national ID card. The scam has brought enormous damage to people living in the eastern region, and may escalate in other areas.

KASIKORNBANK wishes to recommend that the general public exercise additional caution about individuals or groups of persons – likely to be acquaintances or respected community members – who may pretend to offer assistance and persuade victims to apply for a loan from a financial institution using only a national ID card as evidence. They may trick the victims into scanning their face for identity verification. The scammers then download a financial institution’s application and open an e-savings account to accept a loan before applying for a loan from a financial institution, all while using the victims’ identity. Once the loans have been approved by financial institutions per their established procedures, the funds are transferred to the borrowers’ (the victims’) accounts that were opened by the scammers. The victims’ loans are then embezzled by the scammers. Consequently, some victims may get only a fraction of the entire loan for themselves, and others may get no money at all. Eventually, all of the victims must shoulder substantial debts with financial institutions under the lending transactions.

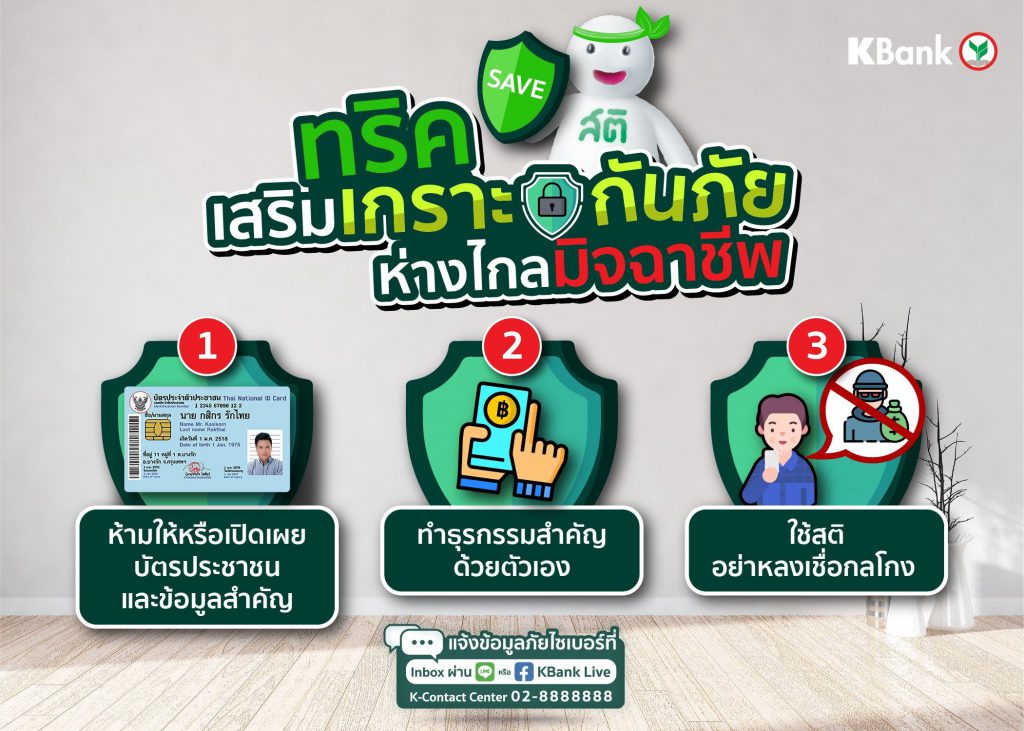

KBank’s advice is as follows:

1. Your national ID card is an important personal document that must always be kept safe and secure. Never give your original national ID card or its copy to anyone, or entrust other persons to conduct transactions on your behalf, due to the risk of fraud in varying forms.

2. Important transactions such as account opening, financial services and loan application should be conducted yourself.

3. Don’t fall prey to deception, and keep your personal documents confidential. Stay vigilant of scammers, and carefully consider the intentions of people offering assistance in various forms.

4. Regardless of the purpose for the loan application, borrowers are obligated to repay the amount with interest. Therefore, potential borrowers should apply for a loan only if they are truly in need of cash. Don’t focus merely on the short-term benefits offered by a third party, because it could lead to an enormous long-term debt for yourself and your family.

5. In case of queries or uncertainty regarding any information, please contact the responsible agency directly.