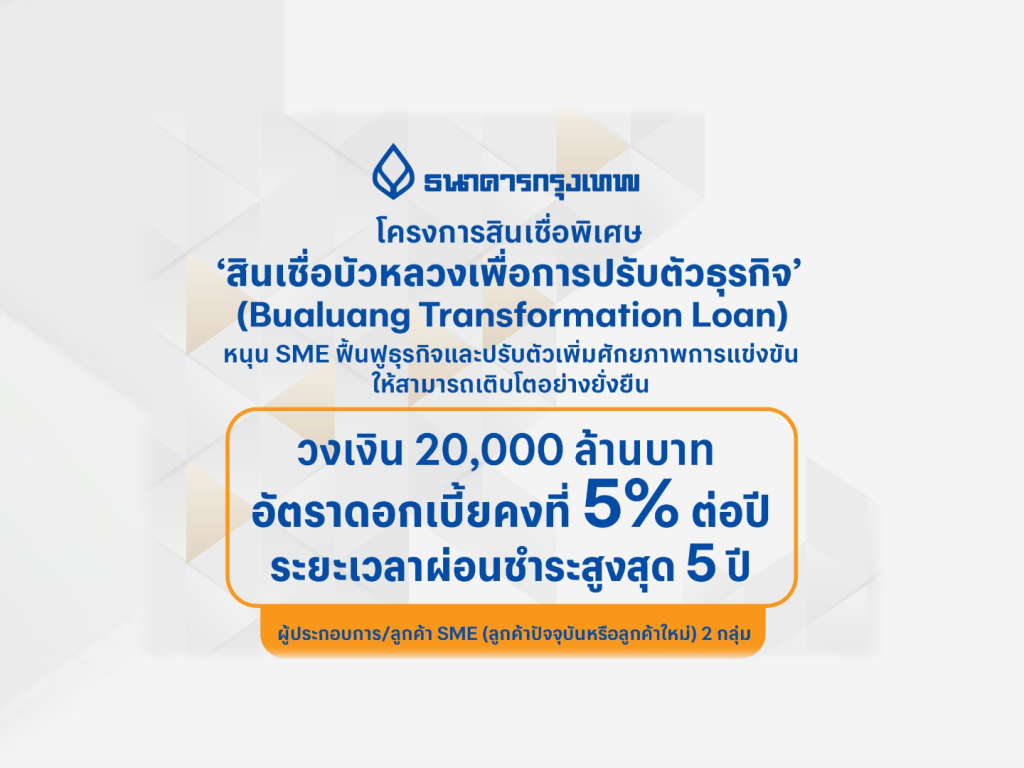

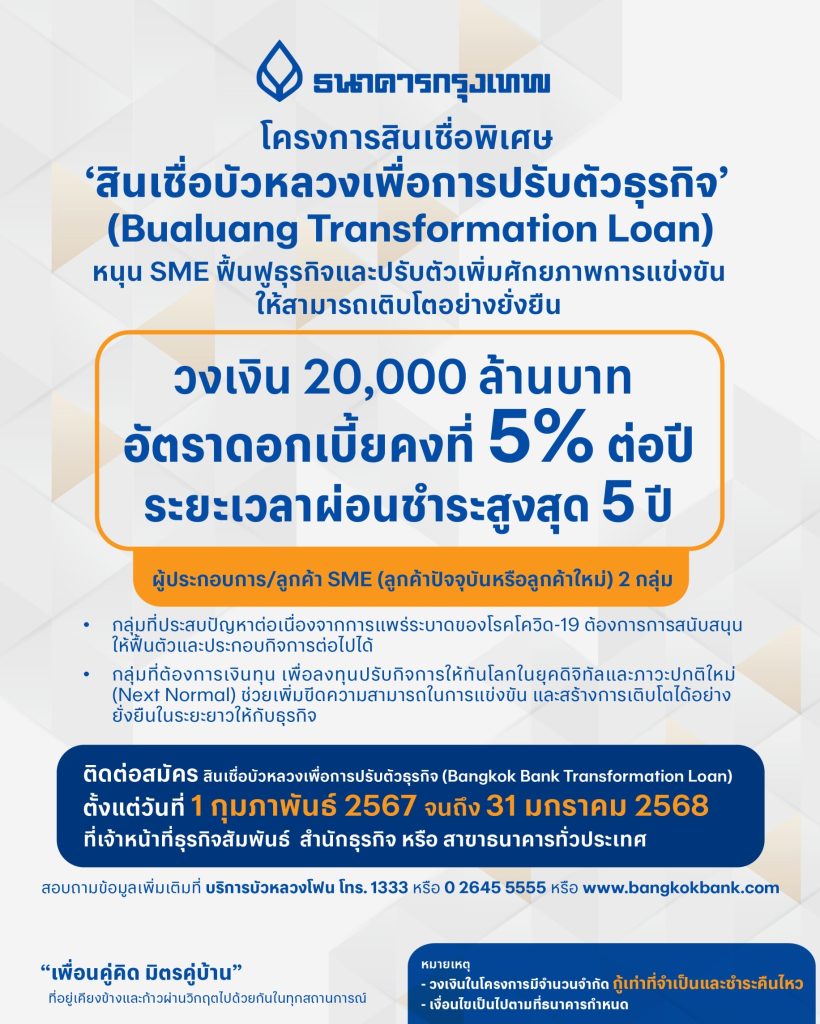

Bangkok Bank launches 20-billion-baht Bualuang Transformation Loan

Bangkok Bank launches 20-billion-baht Bualuang Transformation Loan program to support SME and facilitate their competitiveness and sustainable growth with a fixed interest rate of 5% per year

Bangkok Bank President Chartsiri Sophonpanich said that the economy and business environment are changing rapidly and continuously which is a result of digitalization, regionalization, and urbanization. Bangkok Bank recognizes the need to help customers adapt to various changes as the Bank’s strategy is to support the Thai business sector to be more competitive and ready to expand business in foreign markets to benefit from being part of the global supply chain. In this regard, the Bank has launched the Bualuang Transformation Loan program with a total credit line of 20 billion baht with a fixed interest rate of 5% per year and a repayment term of up to five years to assist two groups of SME customers: a group that continues to be impacted by issues that emerged during the Covid-19 pandemic and requires continuous assistance to help their businesses thrive again, and a group that needs funds to invest in transforming their business to cope with digital transformation, transitioning to the Next Normal, technology changes, higher energy prices, and other disruptive factors, so that they can increase their competitiveness and create long-term sustainable growth.

“Bangkok Bank places great emphasis on taking care of all customer groups as a trusted partner and reliable friend who stays close to them so that we can get through this crisis together. Bualuang Transformation Loan is a special loan program to provide assistance to SME customers in addition to our existing loan assistance programs. For the group that needs to get the loan to recover their business, the Bank is not only offering loans, but also continuing to closely monitor and evaluate the situation and provide advice to customers accordingly. Another group is SME customers who need to adjust their business to the current situation and the various opportunities it provides. For this group, we will focus on supporting investment to improve or procure machinery, equipment and tools, as well as systems and processes, in three key areas of business transformation: digital technology, green business, and innovation. This will help enhance their business potential by increasing their competitiveness and ability to deliver sustainable growth.”

Mr. Chartsiri said: “Amid this global economic volatility, Bangkok Bank is ready to take action to support customers to overcome challenges and difficulties together. If the situation changes and our customers require further support for other reasons, we will consider providing assistance in addition to this special loan program.”

Interested SME businesses, both existing or new customers, can apply for the Bualuang Transformation Loan from February 1, 2024, to January 31, 2025, (or when credit limit of the program has been fully utilized) by contacting your business relationship officer, business center or Bangkok Bank branch nationwide. For more information, please contact Bualuang Phone 1333 or 0 2645 5555 or visit www.bangkokbank.com.