KLeasing unveils Digital Self-Apply innovation

In response to the prevailing lifestyle of the digital era, KASIKORN LEASING Co., Ltd. (KLeasing) has launched the Digital Self-Apply innovation – a one-stop, easy-to-use platform which allows customers to apply for auto loan by themselves via digital channel.

After uploading related documents, the applicant will be instantly informed of the approval results in real time. To begin with, customers who have booked a Tesla via website can apply for loan with approval results given via mobile phone before taking delivery of the purchased car. KLeasing is determined to create an ecosystem with linkage to its partners’ platforms across various brands, especially leading electric vehicle brands, in order to respond to customers’ needs in this new era. In alignment with the GO GREEN Together project initiated by KASIKORNBANK, KLeasing aims to leverage its strength in order to offer special benefits to KBank customers while gearing up for the launch of attractive campaigns year-round to promote new car purchases.

Mr. Tirachart Chiracharasporn, KLeasing Managing Director, said, “In this new era, consumers have become more familiar with the use of digital platforms, including mobile phones, tablets, websites and applications, thanks to their convenience in buying goods and using services, including car booking and purchase, which can be done with ease online. As evidenced, a large number of people booked Teslas via website last year.

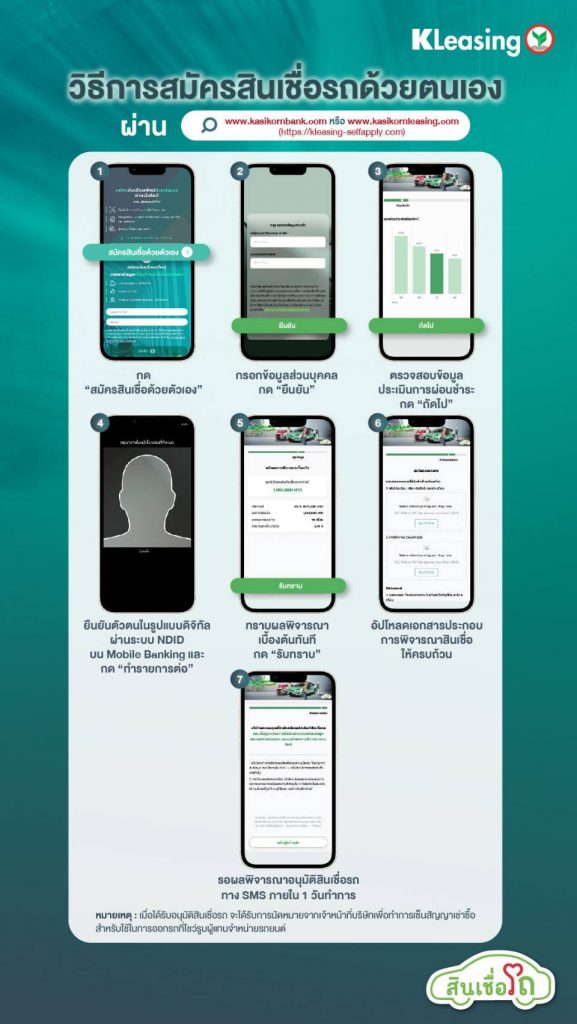

“KLeasing has therefore responded to such customers’ needs by offering auto loan services via a digital platform, with the aim of creating a seamless service experience for those wishing to apply for an auto loan by themselves. Equipped with identity verification technology and comprehensive online credit scoring approval processing, our digital platform for auto loan services allows customers to verify their identity through the National Digital ID Company Limited (NDID) and National Credit Bureau (NCB). Loan approval is based on i-Scoring, which helps increase the precision and likelihood of loan approval, specifically for KBank’s customers to know their online loan approval results in real time.” Customers can apply for auto loan by themselves with ease via mobile phone or computer at www.kasikornbank.com, www.kasikornleasing.com (https://kleasing-selfapply.com/). Steps are as follows:

1.Provide information of loan applicant and specify the car for which you are applying for a loan.

2.Verify your identity via NDID using the mobile banking application. You will know the preliminary loan approval result immediately.

3.Upload the required proof of income for credit underwriting.

4.Receive loan approval result via SMS to confirm the loan approval.

5.Sign hire purchase contract with the officer and receive car at the dealer’s showroom.

Mr. Tirachart added, “The development of Digital Self-Apply will also enhance our lending standards for customers in the digital age, leading to collaboration between leading car dealers and KLeasing. Customers, especially those who have booked electric cars, can apply for auto loans and get online approval immediately. This is a pilot program that may lead to new patterns of auto loan application in Thailand in the future. In addition, KLeasing is preparing to develop API services in connection with platforms of partner car companies. Our initial aim for early 2023 is to reach 1,200 auto loan applications with a total loan amount of more than 1,000 million Baht – to be granted via this self-apply platform only. Additionally, KLeasing continues to launch campaigns to penetrate other markets, focusing on segments with growth potential. Plus, in alignment with the GO GREEN Together policy of KASIKORNBANK, the company aims to help foster a green society in Thailand.”