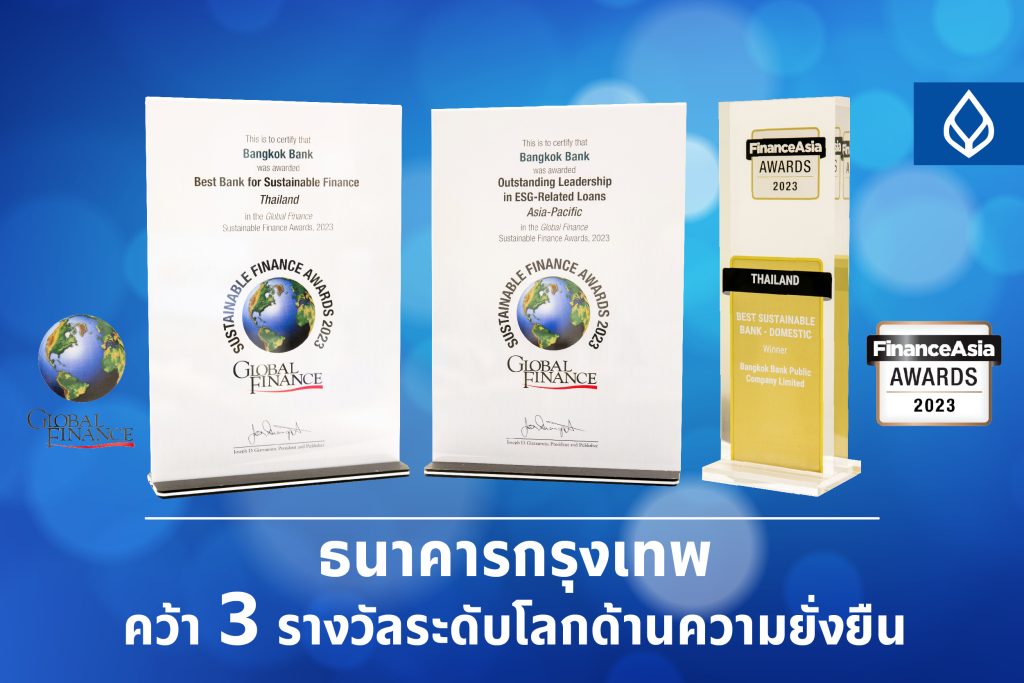

Bangkok Bank receives 3 global awards

Bangkok Bank receives 3 global awards for sustainability while emphasizing

Bangkok Bank received two awards for sustainability from Global Finance, a global financial magazine, and one from FinanceAsia, a regional financial magazine, reflecting its success as a regional financial institution with expertise, experience and commitment to sustainable growth. The Bank continues to focus its business development on five sustainability themes while being a trusted partner to stakeholders and continuing its journey of creating value for a sustainable future.

Bangkok Bank Executive Vice President and Corporate Finance Department Manager Prasert Deejongkit said Bangkok Bank received three sustainability awards, namely: Best Bank for Sustainable Finance in Thailand and Outstanding Leadership in ESG-Related Loans for Asia Pacific from the Sustainable Awards 2023 of Global Finance, a leading English financial magazine; and Best Sustainable Bank in Thailand in 2023 from FinanceAsia, a leading financial and investment magazine in Asia-Pacific. The awards reflect Bangkok Bank’s success as a leading regional bank with outstanding expertise, extensive financial experience, and commitment to sustainable development.

The awards were judged on various sustainability metrics such as: policy and standards, the development of financial products and services with ESG considerations, targets and timelines for sustainable finance, measurement of sustainable finance, achievement of sustainable finance, and third-party reviews.

The Bank plays an important role in funding sustainability activities of leading government and private organizations in Thailand. In 2022, the Thai capital market had a total value of ESG bonds issuance of Baht 157,463 million, of which Baht 119,145 million, or 76 percent of the total ESG bond issuance, was underwritten by the Bank. In addition, the Bank supported loans for renewable energy totaling 88.1 billion baht, and, in the same year, issued a credit line of 17.8 billion baht or 28.1 percent of the total loans for the construction of two new electric train lines in Bangkok and its vicinity. The Bank also offered a special loan program for SME, Bualuang Green Loan, with a total credit line of over 1,200 million baht, to meet the needs of entrepreneurs wishing to invest in renewable energy projects such as solar, wind, and hydro power. In 2023, the Bank has provided Bualuang Green Solar Energy to meet the needs of customers in installing solar rooftops and offered transformation loans under the Soft Loan Emergency Decree for entrepreneurs wishing to invest in the development of digital technology, green business operations, or technology and innovation, in order to enhance their business potential and competitiveness.

“Bangkok Bank is honored to receive these awards for its sustainable finance achievements. As a financial institution, we need to understand and support sustainability which is an important global issue. The Bank emphasizes sustainability through our policies and integration into our business processes. The awards, which were reviewed rigorously, show that we are on the right path, while giving us the confidence and support we need to continue developing our business in a sustainable manner.

Mr. Prasert added that Bangkok Bank has always focused on sustainable development at the policy level and is now integrating it into business processes that cover environmental, social and governance dimensions. As such, the Bank is able to provide various kinds of financial support for businesses in their transition towards sustainability through responsible lending and efficient risk management. This delivers long-term value for society in line with the Bank’s goal to create value for a sustainable future which comprises five sustainability themes as follows:

Be Responsible – doing business in a responsible way by integrating the concept of sustainability into the business process using various financial tools to support environmentally-friendly projects. The Bank is a leader in the underwriting of eco-friendly bonds, including green bonds, social bonds and sustainability bonds, as well as sustainability-linked bonds. In 2022, the Bank was the underwriter of around 76% of the total value of ESG bonds in Thailand. The Bank also provided loan support to finance investments in clean energy power generation projects, Bualuang Green Loans, the ESCO Revolving Fund project, and loans for solar rooftop installation.

Be Resilient – coping with crisis This is in line with the Bank’s commitment to be a trusted partner who stays close to customers in every circumstance. A major project has been taking care of customers and society affected by the Covid-19 outbreak whereby the Bank provided short-term, medium-term and long-term financial assistance according to customers’ needs on a case-by-case basis using the Bank’s liquidity. Customers were also assisted under the government’s loan rehabilitation scheme as well as the household and SME assistance program under the Debt Mediation Fair.

Be Caring – taking care of society The Bank gives back to Thai society through various social initiatives such as projects to mitigate drought-induced crises, to preserve and promote Thai arts and culture, support youth development, and promote educational opportunities.

Be Customer Centric – placing customers at the center of our services by combining sustainability efforts with a business perspective. This begins with a deep understanding of customers that is used to develop financial services that meet their needs anytime, anywhere. A key project is a Cross Border QR Payment service that facilitates mobile banking users to pay for goods and services by scanning QR Code at stores abroad. Meanwhile, merchants in Thailand can now accept payments via PromptPay QR without having to use cash or exchange money. Currently, this service is available between Thailand and several Asean countries, including Vietnam, Indonesia, Malaysia, Singapore, and most recently Cambodia.

Be Ethical – ethical business practices are the heart of a financial business management system that is based on the trust of customers. A pillar of this dimension is the establishment of a responsible financial policy by considering the risks related to ESG (Environment, Social, Governance) in the credit approval process as they apply to both business and personal loans.

“Bangkok Bank is committed to creating value for a sustainable future by providing responsible financial services, managing risk effectively and supporting customers to operate their business in a sustainable manner to deliver long-term value to society. The Bank has transformed these policies into practical projects, activities and measures that are integrated with business, marketing, customer care, and social activities. Most importantly, we take great pride in the success stories in helping customers in their path to sustainable growth. This reinforces the Bank’s position as a trusted partner who is ready to take care and grow alongside all stakeholders in a sustainable way,” concluded Mr. Prasert.