SCB EIC upgraded Thailand’s economic outlook to 3.9% in 2023

SCB EIC upgraded Thailand’s economic outlook to 3.9% in 2023, mainly driven by tourism sector, private consumption and the better-than-expected global economy. However, rising concern over global financial stability became new risk that warrants close monitoring.

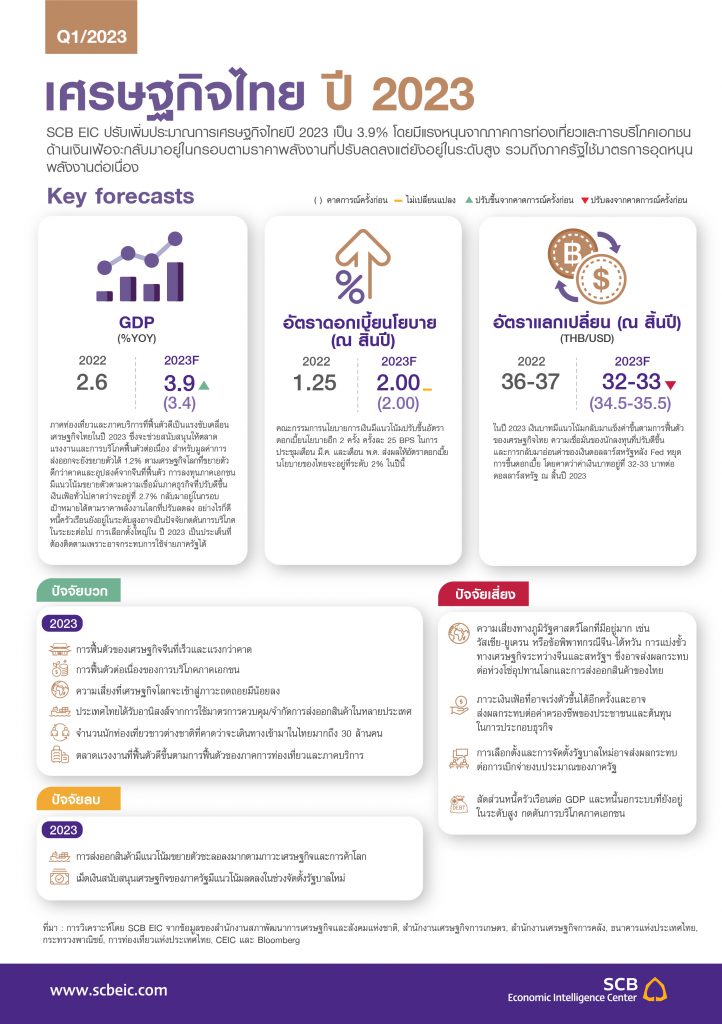

SCB EIC revised up Thailand’s economic growth forecast to 3.9% (previously 3.4%) in 2023, thanks to an upbeat rebound from the tourism and service sectors. Foreign tourist arrivals will likely hit 30 million in 2023 before resuming the pre-pandemic pace by late 2024. With China lifting its Zero-COVID restrictions, Chinese visitors should bounce back to around 4.8 million this year, alongside improving tourist arrivals from other countries. This would support the labor market and consumption recovery. Meanwhile, Thai exports outlook remained quite somber but would expect a 1.2% growth this year, thanks to a better-than-expected global economic growth and an upside rebound in Chinese demand. The Middle East, CLMV, and Latin America are also the potential markets for Thai export opportunities. On the domestic front, private investment is expected to gain traction in tandem with improving business sentiment and notable increases in the number of applications and certificates for investment promotional privileges. Moreover, the headline inflation is expected to stay within a target range at 2.7%, given falling global energy prices and ongoing energy subsidies from the government. Meanwhile, the core inflation will decline to 2.4% yet remain elevated, reflecting higher cost pass-through from producers to consumers on the back of stronger economic momentum and demand-pull inflationary pressures.

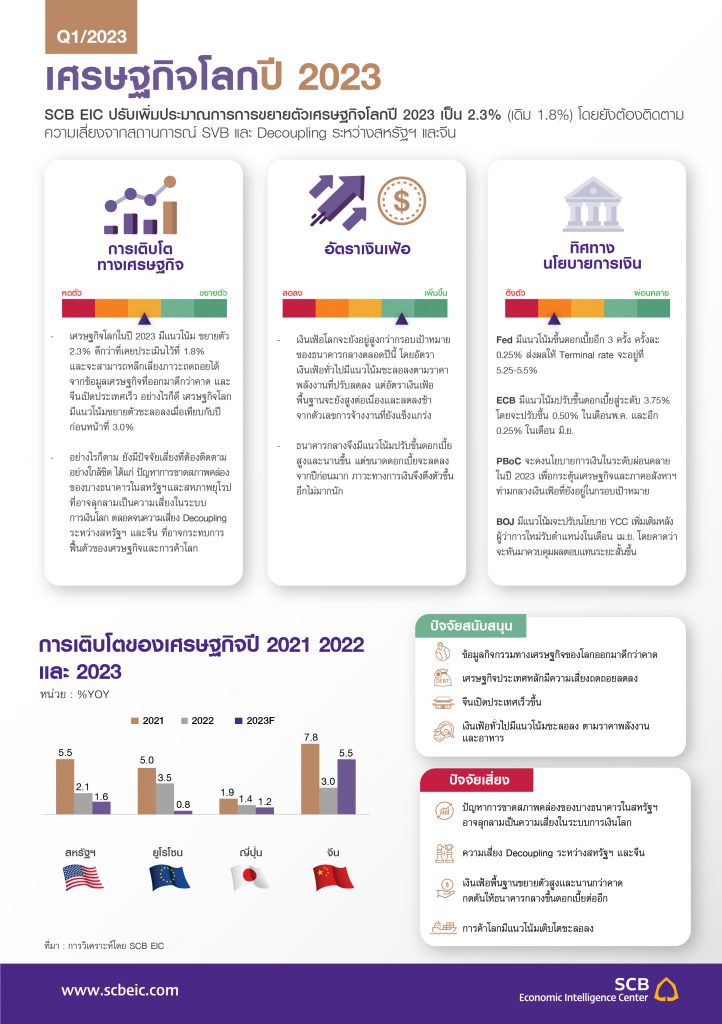

Somprawin Manprasert, Ph.D., First Executive Vice President, Chief Strategy Officer and Chief Economist of the Economic Intelligence Center (EIC) at the Siam Commercial Bank PCL, stated that “SCB EIC expects the global economy to perform better than previously forecasted. Hence, we upgraded our global economic forecast from 1.8% to 2.3%. An upward revision was attributed to key economic outturn which beat the consensus an China’s rapid reopening. The US and EU economies would eventually avoid recession. China’s economy will witness robust growth, as the reopening after a three-year lockdown should unleash the pent-up private consumption. Furthermore, recent turmoils around the collapse of the US Silicon Valley Bank (SVB), following a liquidity crisis, could ripple the global financial market’s sentiment and liquidity in the short term. The SVB shutdown is unlikely a repeat of the 2008 crisis, yet considered an alarming risk that should be aware of. Another downside risk comes from the US-China geopolitical conflicts that could imperil the global economy, global trade, and global supply chain.”

He also added that “The global headline inflation will likely cool down along with a decline in energy prices. In contrast, the core inflation—an important figure for the central bank’s decision—would fall back more slowly due to robust employment readings, which helped strengthen labor income and spending. As a result, we expect the major central banks to stay the course on rate hikes and keep their policy rate high for an extended period. The Fed will likely push its benchmark funds rate to 5.25-5.5% (previously 5.0-5.25%), while the ECB would raise its policy rate to 3.75% (previously 3.25%). Nonetheless, the pace of rate hikes should be slower than in 2022, and the global financial conditions this year will continue tightening, albeit decreasingly.

He stated that “In our view, the tourism sector and consumption would be the significant drivers for Thailand’s economy in 2023. The return of international tourists should shore up businesses in the tourism ecosystem, particularly those with high reliance on Chinese tourists. Besides, Thailand’s labor market has regained its pre-pandemic momentum thanks to a buoyant economic rebound and workers returning to the tourism and service sectors, thus resulting in higher wages in the tourism industry.

He added that “There remain major downside risks ahead to the Thai economy: (1) Escalating geopolitical risks could disrupt the global supply chain and Thai exports, (2) Global financial conditions become acutely tightened as the global inflation eases slowly, (3) Swelling household debt would repress consumption, and (4) Policitcal uncertainties might deter investment sentiment and future government spending. Moreover, arising concern in global stability became new risk that needed closely monitor. As long as the central banks can provide liquidity facility in a timely and sufficient manner, trust in the stability of banking system still remains.

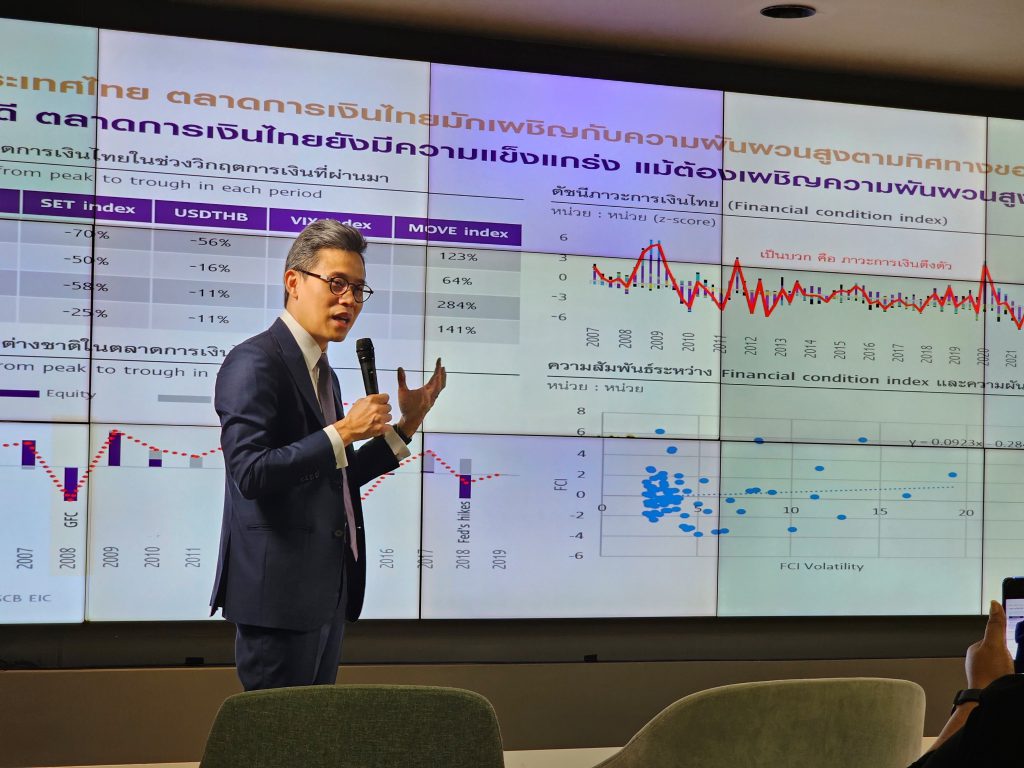

Thitima Chucherd, Ph.D., Head of Economic and Financial Market Research of the Economic Intelligence Center (EIC) stated that “In case of global financial crisis resurgence, global economy might fall into a recession. EMs might encouter negative spillovers via four channels, namely, export slump, capital flight, tightening financial condition, and monetary policy divergence for those countries with external vulnerability being forced to hike rates more aggressively to shore up currency. Thai economy might also face adverse impacts on exports and financial conditions. Thai financial markets might encounter rising volatility similar to global financial markets. SET index might be shaken off following equity outflows, however, Thai financial markets would withstand rising volatility over the previous financial crises. Our analysis shows that rising volatility in overall financial conditions stress on financial conditions to some extent. Also, impacts of falling equity prices on Thai household wealth will be limited.”

She further added that “Still, household debt which remained persistently high could hamper future consumption—an alarming risk that calls for urgent solutions from the government. Based on the latest SCB EIC Consumer Survey, the share of respondents with expense outweighing income during the past six months has been on the rise, notably among the low-income cohorts. The number of newly indebted respondents also rose sharply since the COVID-19 outbreaks—most of them tended to borrow more for debt refinancing. In particular, borrowers with informal debt remained our top concerns as they are likely to borrow more and could get caught in a debt trap.”

She also pointed out that “The General Election 2023 is another issue that warrants close monitoring since it might affect the government expenditure. Still, this would primarily depend on how fast the new government could enforce the FY2024 budget decree. In SCB EIC base case, the upcoming election and the transition to the new regime will not significantly deter public spending in 2023. The reasons are that the current government has disbursed much of the allocated investment budget since early FY2023—the amount already surpassed those of previous fiscal years—and also gave the green light to new public construction projects. Hence, we expect a lower budget disbursement from the interim government during a transition, and the FY2024 budget decree should delay by no later than three months. However, if political unrest holds up the new budget enforcement further than our base case, the government spending in 2023-2024 would be adversely affected, particularly the public investment.”

SCB EIC expects the MPC to carry on the policy rate hike to 2% in H1/23, given a steady economic rebound and slowly easing inflation. Thailand’s financial condition should tighten further as central banks globally opt for

a policy rate increase, whereas financial supports start to peter out. The Thai baht is expected to weaken during H1/23 but regain steam against the greenback to 32-33 THB/USD at year-end 2023, backed by Thailand’s improving economic fundamentals. In contrast, the US dollar is likely to lose pace, notably after the Fed ends its rate hike in H2/23.

By : Somprawin Manprasert, Ph.D (somprawin.manprasert@scb.co.th)

First Executive Vice President, Chief Economist at Economic Intelligence Center (EIC), Siam Commercial Bank and FEVP, Chief Strategy Officer at Siam Commercial Bank.

Thitima Chucherd, Ph.D. (thitima.chucherd@scb.co.th) Head of Economic and Financial Market Research, Economic Intelligence Center (EIC), Siam Commercial Bank.

EIC Online : www.scbeic.com

Line : @scbeic